Incoterms 2020, short for International Commercial Terms 2020, are a set of 11 standardized rules published by the International Chamber of Commerce (ICC) to define the responsibilities of sellers and buyers in international trade transactions. These rules specify who is responsible for the costs, risks, and tasks associated with the delivery of goods from sellers to buyers. Incoterms 2020, the latest edition, provides clarity and security to participants in global trade by clearly outlining the obligations, costs, and risks involved in the delivery of goods across international borders. This edition introduces updates and clarifications to accommodate modern trade practices, enhancing the understanding and usage of Incoterms in contracts for the sale of goods worldwide. Incoterms were first introduced by the ICC back in 1936 (1st edition).

INCOTERMS® LATEST EDITION 2020

WHAT ARE INCOTERMS

Incoterms 2020, the latest edition of the International Commercial Terms published by the International Chamber of Commerce (ICC), serves as a fundamental framework for international trade. These terms consist of three-letter acronyms that reflect common sets of rules and standards in global trade contracts, defining the responsibilities of buyers and sellers for the delivery of goods under sales contracts. Incoterms 2020 provides clear guidance on the division of costs, risks, and responsibilities between the buyer and seller, as well as information on the transportation and delivery of goods. This edition, effective from January 1, 2020, updates and clarifies the previous Incoterms rules to better reflect current trade practices.

KEY FEATURES OF INCOTERMS 2020

Incoterms 2020 have been updated in 2020, following previous releases (the most recent ones being 2010 and 2013). The key features of Incoterms 2020 are:

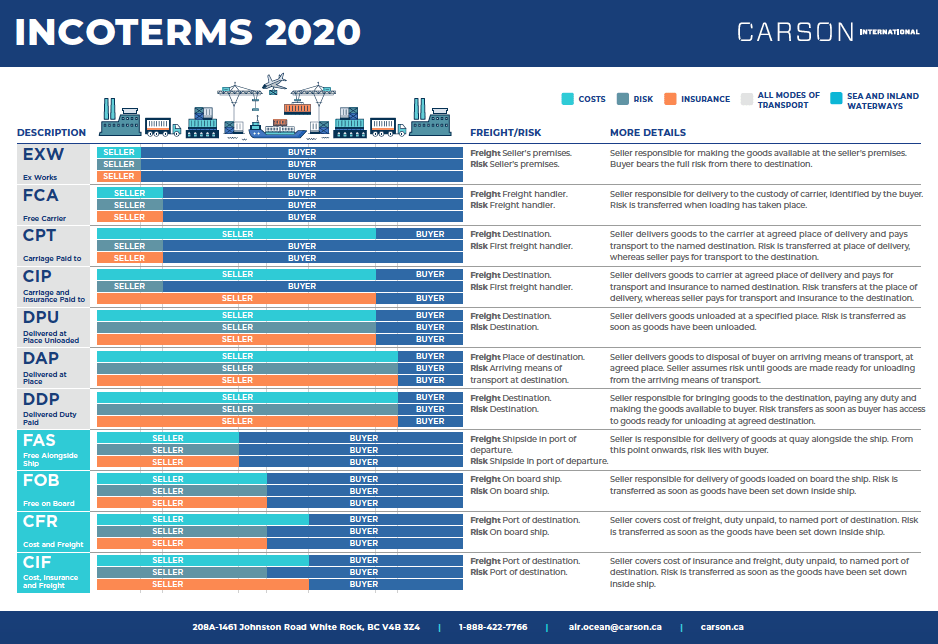

- 11 Rules: The Incoterms 2020 are divided into 11 rules, categorized for any mode of transport (EXW, FCA, CPT, CIP, DAP, DPU, DDP) and for sea and inland waterway transport (FAS, FOB, CFR, CIF).

- Updates and Clarifications: This edition includes significant updates, such as more detailed guidance to help users choose the right Incoterm for their transaction, enhanced security-related requirements within carriage obligations, and changes to the FCA (Free Carrier) rule regarding onboard bill of lading under buyer’s request.

- Insurance and Transportation: Incoterms 2020 also addresses issues of insurance coverage in the CIF (Cost Insurance and Freight) and CIP (Carriage and Insurance Paid To) rules, increasing the insurance required under CIP but maintaining the existing level of insurance coverage under CIF.

- Cost Clarity: The terms now provide a clearer representation of the allocation of costs between buyer and seller to prevent unexpected charges.

- DPU Rule: Incoterms 2020 introduced the DPU (Delivered at Place Unloaded) rule, which replaced the DAT (Delivered at Terminal) rule, clarifying that delivery can happen at any place, not just a terminal.

RELEVANCE OF INCOTERMS 2020

Incoterms play a crucial role in global trade by minimizing or eliminating uncertainties arising from different interpretations of the rules in different countries. They are essential for drafting international trade contracts, ensuring that all parties have a clear understanding of their obligations, thus reducing the risk of legal complications. By standardizing the terms, Incoterms 2020 facilitates smoother transactions and helps build a more cohesive and efficient international trade system.

C-INCOTERMS 2020

C-type Incoterms 2020 are a subset of the Incoterms rules that define contracts where the seller bears the cost of shipping goods to a destination but not the risk of loss or damage to the goods or any additional costs due to events occurring after shipment and dispatch. The C-group Incoterms are particularly significant for transactions where the goods are transported over long distances, typically in international trade. The buyer assumes the risk once the goods are handed over to the first carrier. The characteristics of C-type Incoterms 2020 are:

- Cost Transfer: In all C-type terms, the seller bears significant costs up to a certain point in the journey, but not the risk past the point of shipment.

- Risk Transfer: Risk transfers from seller to buyer much earlier than the transfer of costs, which can be counterintuitive. Buyers must understand that while the seller pays for transport, the buyer assumes the risk once the goods are shipped.

- Insurance in CIF and CIP: Only CIF and CIP require the seller to obtain insurance on behalf of the buyer. However, the level of insurance coverage differs, with CIP requiring a higher level of insurance than CIF according to Incoterms 2020.

CFR (Cost and Freight)

The CFR (Cost and Freight) Incoterm 2020, established by the International Chamber of Commerce (ICC), is part of the Incoterms 2020, the latest edition of these standardized trade definitions, which are designed to facilitate global trade by clarifying the tasks, costs, and risks involved in the delivery of goods from sellers to buyers.

Key Responsibilities under CFR Incoterm 2020:

Seller’s Responsibilities:

- Delivery and Transport: The seller must arrange and pay for the transportation of the goods to the named port of destination. This includes all costs associated with export formalities and the loading of the goods onto the ship.

- Risk Transfer: Under CFR, the risk of loss or damage to the goods transfers from the seller to the buyer as soon as the goods have been loaded onto the shipping vessel at the port of shipment. Despite covering the cost of freight to the destination port, the seller is not responsible for insuring the goods during transit.

- Documentation: The seller is responsible for providing the buyer with the necessary documents to claim the goods at the destination port, typically a bill of lading.

Buyer’s Responsibilities:

- Unloading Costs: The buyer is responsible for the costs associated with unloading the goods at the destination port.

- Transport from Port: After the goods have reached the destination port, the buyer bears all costs and risks involved in transporting the goods from the port to their final destination.

- Import Formalities and Taxes: The buyer handles and pays for import duties, taxes, and any other costs related to clearing the goods for import into the destination country.

Usage and Considerations:

- Applicability: CFR is exclusively used for goods transported by sea or inland waterway. For other modes of transport, different Incoterms should be considered.

- Insurance: Since CFR does not require the seller to insure the goods during transit, the buyer may choose to arrange additional insurance coverage to protect against transit risks.

- Clarity on Risk and Cost: Parties using CFR must clearly understand that while the seller is responsible for arranging and paying for shipping to the destination port, the buyer assumes the risk once the goods are loaded onto the ship.

CFR Incoterm 2020 simplifies international trade transactions by specifying that the seller is responsible for arranging and covering the cost of freight to the destination port, while the buyer takes on the risk and additional costs from the point the goods are loaded onto the vessel. This clear delineation helps prevent misunderstandings and disputes regarding shipping responsibilities in international sales contracts.

CIF (Cost, Insurance, and Freight)

The CIF (Cost, Insurance, and Freight) Incoterm 2020 is a trade term used in international commerce, defined by the International Chamber of Commerce (ICC) in the latest set of Incoterms rules. It outlines the obligations, costs, and risks involved in the delivery of goods from the seller to the buyer via sea or inland waterway transport. CIF is one of the Incoterms that places a significant portion of responsibility on the seller, including transportation costs and insurance coverage.

Key Responsibilities under CIF Incoterm 2020:

Seller’s Responsibilities:

- Delivery and Transport: The seller must arrange and pay for the transportation of the goods to the named port of destination. This includes all costs associated with export formalities and loading the goods onto the vessel.

- Insurance: One of the defining features of CIF is that the seller is required to procure marine insurance against the buyer’s risk of loss or damage to the goods during transit. The insurance coverage must be at least 110% of the value of the goods, covering the goods from the warehouse of the seller to the port of destination. The policy should be in the buyer’s name or allow the buyer to make a claim.

- Risk Transfer: While the seller pays for transportation and insurance, the risk of loss or damage to the goods, as well as any additional costs due to events occurring after the goods have been loaded onto the vessel, transfer from the seller to the buyer.

Buyer’s Responsibilities:

- Unloading and Onward Transport: Once the goods have reached the destination port, the buyer is responsible for unloading the goods from the vessel and any subsequent transportation costs.

- Import Formalities: The buyer handles all import duties, taxes, and other charges associated with bringing the goods into the destination country.

Usage and Considerations:

- Suitability: CIF is typically used for bulk cargo or non-containerized goods. For containerized shipments, sellers and buyers might consider using CIP (Carriage and Insurance Paid To), which is more appropriate for such cargo.

- Insurance Coverage: Under CIF, the insurance provided by the seller offers minimum coverage. Buyers seeking more comprehensive insurance protection may need to make separate arrangements.

- Risk and Cost Delineation: It’s crucial for parties using CIF to understand that while the seller assumes significant cost responsibilities, including freight and insurance, the risk transfers to the buyer once the goods are loaded onto the ship. This separation of cost and risk can affect decisions in the event of goods being damaged or lost in transit.

CIF Incoterm 2020 ensures clarity in international trade transactions by specifying the responsibilities related to cost, insurance, and freight when goods are transported by sea or inland waterway. It is essential for both sellers and buyers to fully understand and agree upon the use of CIF to ensure the smooth execution of trade agreements.

CPT (Carriage Paid To)

CPT (Carriage Paid To) is one of the trade terms defined in the Incoterms 2020, a set of rules issued by the International Chamber of Commerce (ICC) that outline the responsibilities of sellers and buyers in international trade transactions. The CPT term applies to all types of transport, including multimodal shipments, making it versatile for various shipping methods beyond just sea freight.

Key Responsibilities under CPT Incoterm 2020:

Seller’s Responsibilities:

- Transportation: The seller is responsible for arranging and paying the costs to transport the goods to the agreed destination. This includes handling all the logistics and paying the freight charges necessary to deliver the goods to the named place of destination.

- Export Formalities: The seller must also handle export clearance, including all customs formalities and duties needed to ship the goods out of the country.

- Risk Transfer: Under CPT, the risk of loss or damage to the goods transfers from the seller to the buyer as soon as the goods have been handed over to the first carrier, even though the seller pays for transportation to the final destination. This is a crucial distinction from DDP (Delivered Duty Paid), where the seller assumes all risks until the goods are delivered to the buyer.

Buyer’s Responsibilities:

- Import Formalities: Once the goods arrive at the destination, the buyer is responsible for clearing the goods for import, including paying any applicable duties, taxes, and other charges.

- Additional Transportation: If the agreed destination under CPT terms is not the final destination of the goods, the buyer is responsible for arranging and paying for any additional transportation needed.

Usage and Considerations:

- Versatility: CPT can be used regardless of the mode of transport, making it suitable for shipments that involve a combination of road, rail, air, and sea transport.

- Insurance: The CPT term does not obligate the seller to insure the goods for the main carriage. As the risk passes to the buyer once the goods are handed over to the first carrier, buyers often choose to purchase insurance to cover the transport to the destination.

- Destination Clarity: It’s essential for the contract to clearly specify the named place of destination since this is where the seller’s obligation to pay the costs of carriage ends.

CPT Incoterm 2020 is beneficial for buyers and sellers in international trade by clearly defining the point at which costs and risks shift from the seller to the buyer. It offers flexibility in terms of transportation methods, which is advantageous for complex shipping arrangements involving multiple stages or modes of transport.

CIP (Carriage and Insurance Paid To)

The CIP (Carriage and Insurance Paid To) Incoterm 2020 is a trade term defined by the International Chamber of Commerce (ICC) in their latest Incoterms rules. It outlines the obligations of the seller and buyer in transactions involving the transport of goods from one place to another, applicable to all modes of transport, including multimodal shipments. Under CIP, the seller has significant responsibilities, including the payment of freight and insurance costs to bring the goods to a specified destination. However, the transfer of risk from the seller to the buyer occurs much earlier in the shipping process.

Key Responsibilities under CIP Incoterm 2020:

Seller’s Responsibilities:

- Carriage: The seller arranges and pays for the carriage of goods to the named destination. This includes selecting the carrier and covering all logistics costs involved in moving the goods to the specified point.

- Insurance: A defining feature of CIP is that the seller must also procure insurance against the buyer’s risk of loss or damage to the goods during transit. The minimum coverage required under Incoterms 2020 is for 110% of the contract value, covering the goods from the point of departure to the named destination. The insurance should comply with at least the Institute Cargo Clauses (A) or similar clauses.

- Export and Import Formalities: The seller is responsible for export formalities and costs, while the buyer is expected to handle import formalities and duties.

Buyer’s Responsibilities:

- Risk: Despite the seller paying for carriage and insurance, the risk transfers to the buyer as soon as the goods have been handed over to the first carrier. This means if the goods are lost or damaged in transit, the buyer must claim under the insurance arranged by the seller.

- Additional Transportation: Once the goods have arrived at the agreed destination, the buyer is responsible for any additional costs and risks if the goods are not unloaded or moved beyond the destination.

Usage and Considerations:

- Versatility: CIP can be used for any mode of transport, including road, rail, sea, air, or a combination of these, making it versatile for global trade.

- Insurance Coverage: The seller’s obligation to procure insurance provides the buyer with a level of protection against transit risks. However, buyers may seek additional coverage based on the nature of the goods or the specific risks involved.

- Cost and Risk Dichotomy: The separation of cost and risk responsibilities requires clear communication and understanding between the buyer and seller, especially regarding the point of risk transfer and the extent of insurance coverage.

CIP Incoterm 2020 is designed to provide a balanced approach to dividing the costs, risks, and responsibilities between the seller and buyer in international trade transactions. It is especially relevant for transactions requiring comprehensive transportation arrangements and insurance coverage, ensuring that goods are transported and insured up to the named destination with a clear transfer of risk.

D-INCOTERMS 2020

The D-type Incoterms 2020, defined by the International Chamber of Commerce (ICC), denotes delivery terms where the seller takes on maximum responsibility up to the point of delivery at the destination. These terms are often used when the seller agrees to assume all risks and costs until the goods are delivered to the buyer at a specified location.

D-type Incoterms 2020 facilitates transactions where sellers are willing or able to manage the end-to-end delivery process, offering buyers convenience but typically at a higher cost. Understanding the specifics of each D-type term is crucial for both buyers and sellers to ensure that contractual obligations are clear and achievable within the logistical and regulatory context of the destination country.

Characteristics of D-type Incoterms:

- Maximum Obligation for the Seller: D-type terms place the highest degree of responsibility on the seller in terms of shipping costs and risk management until the goods are delivered to the buyer.

- Variety of Delivery Locations: Unlike other Incoterms that specify delivery at the seller’s premises or on board a vessel, D-type terms can involve delivery to a location deep within the buyer’s country, potentially including the buyer’s premises.

- Considerations for Buyers and Sellers: When using D-type Incoterms, parties need to clearly understand and negotiate the designated point of delivery and the specific obligations involved, especially concerning duty payment and unloading of goods.

As of the Incoterms 2020, the D-type terms include:

DAP (DELIVERED AT PLACE…)

DAP (Delivered At Place) under Incoterms 2020 is a trade term defined by the International Chamber of Commerce (ICC) that specifies the seller delivers the goods to a place agreed upon by both parties. The seller bears all risks and costs associated with delivering the goods to the named destination, except for any costs related to import clearance.

Key Responsibilities under DAP Incoterm 2020:

Seller’s Responsibilities:

Transportation: Arrange and cover the costs for transporting the goods to the agreed-upon destination.

Risks: Bear all risks until the goods are made available to the buyer at the named place of destination.

Customs, Taxes, and Duties: While the seller is responsible for all costs up to the point of delivery, the buyer is responsible for any cost of import clearance, including duties, taxes, and other charges.

Export Formalities: Handle and pay for export formalities, licensing, and documentation required for shipping the goods.

Buyer’s Responsibilities:

Import Clearance: Carry out and pay for import customs formalities, including duties, taxes, and other official fees.

Unloading: Responsible for unloading the goods at the destination.

Onward Transportation: If the goods are to be transported further from the agreed delivery point, the buyer covers these additional costs and risks.

Usage and Considerations:

Flexibility in Delivery Location: DAP can be used for any mode of transportation and offers flexibility regarding the delivery location, which can be anywhere other than a terminal – for example, a warehouse, a factory, or a construction site.

Control Over Costs and Risks: DAP gives the seller control over the transportation process and costs, until the goods are delivered to the specified location, at which point the buyer, assumes responsibility for import clearance and any further movement.

Import Duties and Taxes: Under DAP, the buyer is responsible for handling and paying import duties and taxes. This necessitates that the buyer has the ability or the representation to perform import customs clearances.

DAP is particularly suitable for buyers and sellers seeking a balance of responsibilities where the seller manages the transportation and risk up to the destination point, but the buyer takes on the responsibility for import clearance. It’s a common term used in international trade agreements to simplify logistics arrangements, especially in transactions where the buyer prefers to manage the import process directly.

DPU (DELIVERED AT PLACE UNLOADED)

DPU (Delivered at Place Unloaded) under the Incoterms 2020, introduced by the International Chamber of Commerce (ICC), signifies a term where the seller delivers the goods – and directly unloads them from the arriving means of transport – at a named place (agreed upon by the seller and buyer). It is one of the Incoterms that places significant obligations on the seller, making it unique because it is the only term that requires the seller to unload the goods as part of the delivery process.

Key Features of DPU Incoterm 2020:

Seller’s Responsibilities:

Delivery and Unloading: The seller must deliver the goods to the agreed-upon place, which can be any location, and is responsible for unloading the goods from the arriving means of transport. This includes covering all costs and risks until the goods are delivered and unloaded.

Export Formalities: The seller is responsible for clearing the goods for export, which involves handling all the customs formalities needed for exporting the goods.

Transportation: Arrange and pay for all transportation costs up to the named place of destination. This includes any internal transport in the seller’s country, international shipping, and any other costs associated with getting the goods to the destination.

Buyer’s Responsibilities:

Import Formalities: The buyer is responsible for import clearance, which includes paying import duties, and taxes, and handling all the paperwork required for importing the goods into the destination country.

Post-Delivery Transport: If the named place of delivery is not the final destination, the buyer is responsible for any further transportation costs and risks after the goods have been unloaded.

Notification: The buyer must timely provide the seller with any information necessary for the goods to be delivered and unloaded at the named place.

Usage and Considerations:

Flexibility in Location: DPU is flexible regarding the delivery location, making it suitable for various logistical arrangements where the buyer wants the seller to handle delivery and unloading.

Risk and Cost Implications: The seller bears considerable risk and cost until the goods are not only delivered but also unloaded, which is particularly important to consider when the unloading process requires specialized equipment or knowledge.

Specificity of Named Place: It’s critical for the contract to clearly specify the named place of delivery, as the seller’s obligation ends once the goods are unloaded there. Any ambiguity could lead to disputes or misunderstandings regarding the extent of the seller’s obligations.

DPU is a comprehensive term that can be advantageous for buyers who prefer the seller to take on the responsibilities and risks associated with transport and unloading. However, both parties should carefully consider the implications of the delivery and unloading obligations when negotiating contracts using DPU under Incoterms 2020.

DDP (DELIVERY DUTY PAID)

DDP (Delivered Duty Paid) under Incoterms 2020, defined by the International Chamber of Commerce (ICC), is a trade term that places the maximum obligation on the seller regarding the delivery of goods. Under DDP, the seller agrees to deliver the goods to a named place in the buyer’s country, taking on all the risks and costs involved, including transport costs, export and import duties, taxes, and any other charges related to the delivery of the goods right through to the agreed destination.

Key Features of DDP Incoterm 2020:

Seller’s Responsibilities:

Delivery: The seller must deliver the goods to the named place in the buyer’s country, ready for unloading from the arriving means of transport.

Transportation Costs: The seller is responsible for all costs associated with bringing the goods to the named place, including transportation, insurance, and handling charges.

Customs and Duties: Uniquely under DDP, the seller is responsible for clearing the goods for export and import, paying all duties and taxes, and completing all customs formalities.

Risk Transfer: The risk does not transfer to the buyer until the goods are made available to the buyer, ready for unloading at the named destination.

Buyer’s Responsibilities:

Unloading: The buyer is responsible for unloading the goods upon arrival at the named destination.

Further Transportation: If the named place of delivery is not the final destination, the buyer may need to arrange for further transportation from the named place to the final destination.

Cooperation for Customs: While the seller takes on the responsibility for customs clearance, the buyer may need to provide assistance or specific documentation when required for importation into the buyer’s country.

Usage and Considerations:

Suitability: DDP is suitable for buyers who wish to minimize their involvement in the logistics process or for transactions where the seller has a better understanding of the import process in the buyer’s country.

Risk for Sellers: Sellers using DDP should be aware of the significant risks and costs, as they are responsible for the goods until delivery at the named destination, including dealing with local customs and regulations.

Customs and Regulations: The seller must have a thorough understanding of the import regulations and procedures in the buyer’s country to effectively manage the DDP terms, which may include having a local agent or partner to facilitate the customs clearance process.

DDP Incoterm 2020 is advantageous for buyers as it reduces their responsibility and risk to a minimum. However, it requires sellers to have a comprehensive understanding of the importation process in the buyer’s country, including taxes, duties, and regulations, to ensure smooth delivery and compliance.

REVISIONS D-INCOTERMS 2020 VS. PREVIOUS EDITIONS

DAT Incoterm

Does the DAT Incoterm still exist under Incoterms 2020? No, the DAT (Delivered at Terminal) Incoterm does not exist in the Incoterms 2020. It was replaced by the DPU (Delivered at Place Unloaded) Incoterm. The change was made to expand the term’s applicability beyond delivery at a terminal to include any agreed-upon place, whether it’s a terminal or not. DPU requires the seller to deliver the goods to the named place of destination, ready for unloading from the arriving means of transport. This change provides more flexibility in specifying the delivery location, making it more applicable to a wider range of delivery scenarios.

DAF Incoterm

Does the DAF Incoterm still exist under Incoterms 2020? No, the DAF (Delivered At Frontier) Incoterm does not exist in the Incoterms 2020. It was part of older sets of Incoterms but was removed in the Incoterms 2010 revision. The DAF term was used when goods were delivered by the seller to a specified point at the border of a country but not cleared for import. With the introduction of newer terms designed to provide clarity and simplicity in international trade, DAF and several other Incoterms were phased out to streamline the rules. For transactions that would have previously used DAF, parties might consider using terms like DAP (Delivered at Place) or DPU (Delivered at Place Unloaded) under the Incoterms 2020, depending on the specifics of the delivery location and responsibilities they wish to assign.

DES Incoterm

Does the DAF Incoterm still exist under Incoterms 2020? No, the DES (Delivered Ex Ship) Incoterm does not exist in the Incoterms 2020. It was part of the Incoterms 2000 but was removed in the Incoterms 2010 revision. The DES term was used when goods were made available to the buyer on board the ship at the destination port, without being cleared for import. To simplify and update the terms to better reflect current international trade practices, the International Chamber of Commerce (ICC) removed DES and introduced or retained terms that could accommodate the needs previously covered by DES.

For transactions that might have previously used DES, parties are encouraged to consider other Incoterms from the 2020 edition that facilitate delivery to a destination, such as DAP (Delivered at Place), DPU (Delivered at Place Unloaded), or DDP (Delivered Duty Paid), depending on the specific arrangements and responsibilities the parties wish to agree upon.

DEQ Incoterm

Does the DEQ Incoterm still exist under Incoterms 2020? No, the DEQ (Delivered Ex Quay) Incoterm does not exist in the Incoterms 2020. It was included in previous versions of the Incoterms but was removed during the 2010 revision. DEQ specified that the seller delivered the goods on the quay (wharf) at the destination port, and cleared them for import. With the updates, the International Chamber of Commerce (ICC) sought to streamline and simplify the Incoterms to better reflect modern trade practices.

For situations previously covered by DEQ, parties are encouraged to use DPU (Delivered at Place Unloaded), which is applicable under Incoterms 2020. DPU requires the seller to deliver the goods to a named place of destination and unload them at their own risk and cost. This term offers flexibility in terms of delivery locations, including the possibility of delivery at a quay, making it a suitable alternative for scenarios previously addressed by DEQ.

E-INCOTERMS 2020

Under the Incoterms 2020 edition, there is one E-type Incoterm: EXW

“EX-WORKS” (EXW)

EXW (Ex Works) represents one of the Incoterms that places the minimum obligation on the seller and the maximum obligation on the buyer. Under the EXW term, the seller makes the goods available at their premises (factory, warehouse, plant) to the buyer. From that point, the buyer is responsible for all costs and risks associated with the delivery of goods to the final destination.

Key Features of EXW Incoterm 2020:

Seller’s Responsibilities:

- Preparation of Goods: The seller is responsible only for making the goods ready for pickup at their premises on the agreed date or within the agreed period.

- Not Responsible for Loading: Unlike most other Incoterms, under EXW, the seller is not required to load the goods onto a collecting vehicle, nor do they need to clear the goods for export, if applicable.

Buyer’s Responsibilities:

- Transport & Costs: The buyer bears all costs and risks involved in taking the goods from the seller’s premises to the desired destination. This includes transportation, loading charges, customs duties, and any other costs arising during transit.

- Export and Import Clearance: The buyer is responsible for completing all export and import formalities, including obtaining the necessary permissions, paying duties, and carrying out customs clearance.

Usage and Considerations:

- Applicability: EXW can be used for any mode of transport or even when there are multiple modes of transport involved in delivering the goods. It is particularly suited to domestic trade, due to the buyer’s responsibility for export clearance.

- Suitability: While EXW minimizes the seller’s responsibilities, it may place a significant logistical and regulatory burden on the buyer, especially in international transactions where the buyer must handle export formalities in a foreign country.

- Risk and Cost: It offers a clear division of costs and risks, with the buyer taking almost full responsibility once the goods are made available for pickup at the seller’s premises.

EXW is often chosen for transactions where the buyer wants full control over the shipping process or when goods are purchased in situations where the buyer can easily manage local transportation and export formalities. It’s critical for parties considering EXW to fully understand the extent of obligations it imposes, especially for buyers unfamiliar with the seller’s local regulations and export processes.

DIFFERENCE BETWEEN EXW VS. FOB

EXW (Ex Works) and FOB (Free On Board) are two Incoterms defined by the International Chamber of Commerce (ICC) under the Incoterms 2020 rules, each outlining different levels of responsibility and risk for the seller and buyer in an international trade transaction. Understanding the differences between these terms is crucial for both parties to ensure the contract aligns with their logistics capabilities, risk management preferences, and financial considerations.

EXW (Ex Works) Incoterm 2020

- Seller’s Responsibilities: Minimal. The seller makes the goods available at their premises (factory, warehouse, etc.). The buyer is responsible for all other aspects of the shipping process, including loading the goods onto the vehicle, transportation, and export and import formalities.

- Risk Transfer: The risk transfers to the buyer as soon as the goods are made available for pickup at the seller’s premises.

- Cost Implications: The buyer bears almost all costs associated with transporting the goods from the seller’s premises to the final destination.

- Suitability: Best suited for buyers who wish to have full control over the entire shipping process or when transactions are domestic.

FOB (Free On Board) Incoterm 2020

- Seller’s Responsibilities: More extensive than EXW. The seller is responsible for getting the goods to the port of shipment and loading them onto the vessel. The seller must also clear the goods for export.

- Risk Transfer: Risk transfers to the buyer once the goods have crossed the ship’s rail at the port of shipment.

- Cost Implications: The seller covers all costs up to and including the loading of goods onto the vessel at the port of shipment. The buyer assumes all further costs, including sea freight, insurance, unloading, and transportation to the final destination.

- Suitability: Often chosen for sea shipments where the buyer can arrange for the main carriage from the port of shipment but prefers the seller to handle export formalities and loading of the goods.

Key Differences

- Point of Risk Transfer: In EXW, the risk transfers at the seller’s premises as soon as the goods are made available for pickup. In FOB, the risk transfers later, once the goods are on board the vessel at the port of shipment.

- Responsibility for Loading and Transport: Under EXW, the buyer is responsible for loading and transport from the seller’s premises, including export formalities. In contrast, under FOB, the seller is responsible for loading the goods onto the ship and clearing them for export.

- Applicability: EXW can be used for any mode of transport, while FOB is exclusively used for sea or inland waterway transport.

Choosing between EXW and FOB depends on the capabilities and preferences of the trading parties, including who can better manage logistics, the desire to control shipping and insurance costs, and the division of responsibilities for export and import formalities.

F-INCOTERMS 2020

Under the Incoterms 2020, F-type Incoterms include rules that assign the primary responsibility for arranging and paying for the main carriage to the buyer, but place different levels of responsibility on the seller for delivering the goods to the carrier. F-type Incoterms are suitable for buyers who prefer or are in a better position to manage the transportation of goods from a specified point. These terms require clear communication and coordination between the buyer, seller, and carrier to ensure a smooth transfer of goods and responsibilities.

The Key Characteristics of F-type Incoterms:

- Buyer’s Control Over Carriage: In all F-type Incoterms, the buyer arranges for the main carriage, including selecting the carrier and paying the freight charges. This gives the buyer control over the transportation and potential cost savings if they have favorable shipping contracts.

- Seller’s Delivery Obligations: The seller is responsible for delivering the goods to a point where the buyer’s carrier can take over. This includes making the goods available at their premises, alongside a ship, or on board a ship, depending on the specific term used.

- Risk Transfer: Under F-type terms, the risk transfers from the seller to the buyer when the seller fulfills their obligation to deliver the goods to the nominated carrier, not when the goods reach the final destination.

The F-type Incoterms are:

FCA (FREE CARRIER)

FCA (Free Carrier) under Incoterms 2020 is one of the international commercial terms published by the International Chamber of Commerce (ICC) to facilitate global trade. FCA is versatile and can be used across all modes of transportation, making it applicable for both containerized and non-containerized cargo. It outlines specific responsibilities for the seller and buyer regarding the delivery of goods to a predetermined carrier or location.

Seller’s Responsibilities under FCA:

Delivery: The seller must deliver the goods, cleared for export, to the carrier nominated by the buyer at the seller’s premises or another designated location. If the chosen location is the seller’s premises, the seller is responsible for loading the goods onto the buyer’s carrier. If the delivery occurs at any other place, the seller is not responsible for unloading.

Risks and Costs: Up to the point of delivery, the seller bears all risks and costs. Once the goods have been delivered to the carrier or designated place, the risk transfers to the buyer.

Export Formalities: The seller is responsible for export clearance and formalities, ensuring that the goods are legally allowed to leave the country.

Buyer’s Responsibilities under FCA:

Carrier Arrangements: The buyer must contract and pay for the transportation of goods from the named place or location. This includes selecting the carrier and managing the freight costs for the onward journey.

Import Formalities: Upon arrival at the destination, the buyer is responsible for handling import customs clearance and paying any applicable duties and taxes.

Risks Post-Delivery: After the goods have been delivered to the nominated carrier or agreed-upon location, the buyer assumes all risks for any loss or damage.

Key Characteristics:

Flexibility: FCA provides flexibility in terms of the delivery location, which can be the seller’s premises or another specified place. This term accommodates different logistical arrangements, making it suitable for various shipping methods.

Bill of Lading with an On-Board Notation: One significant update in Incoterms 2020 allows for the buyer to instruct the carrier to issue a bill of lading with an on-board notation to the seller, a crucial document for letter of credit transactions in containerized shipments.

Clear Risk Transfer Point: FCA clearly defines the point of risk transfer from the seller to the buyer, providing clarity and reducing disputes over liability.

FCA Incoterm 2020 is widely used in international trade for its adaptability to different transportation methods and for clearly defining the roles and responsibilities of the seller and buyer in the delivery process. It’s particularly advantageous in transactions involving containerized goods, where the goods need to be delivered to a terminal or carrier’s facility.

FAS (FREE ALONGSIDE SHIP)

FAS (Free Alongside Ship) is one of the Incoterms defined by the International Chamber of Commerce (ICC) in the Incoterms 2020 edition, specifically used for sea and inland waterway transport. This term delineates the responsibilities and risks between the seller and buyer when goods are delivered alongside a vessel at a specified port of shipment.

Key Responsibilities under FAS Incoterm 2020:

Seller’s Responsibilities:

Delivery of Goods: The seller must deliver the goods alongside the ship nominated by the buyer at the named port of shipment within the date or period agreed upon.

Export Formalities: The seller is responsible for clearing the goods for export, which includes obtaining any export licenses or other official authorizations needed and carrying out all customs formalities.

Risk Transfer: Risk transfers from the seller to the buyer when the goods are placed alongside the vessel at the named port of shipment. Until this point, the seller bears all risks of loss or damage to the goods.

Buyer’s Responsibilities:

Shipping Arrangements: After the goods are delivered alongside the ship, the buyer must arrange for the loading of the goods onto the vessel and bear all subsequent costs, including freight and charges associated with sea transport.

Import Formalities: The buyer is responsible for clearing the goods for import, including paying any duties, taxes, and other charges incurred during the import process.

Insurance: While FAS does not obligate the seller to procure insurance, the buyer may choose to insure the goods from the time they are delivered alongside the ship.

Usage and Considerations:

Applicability: FAS is specifically intended for bulk or non-containerized cargo that is loaded directly onto ships, such as oil, grains, or coal. It is less commonly used for containerized goods.

Risk and Cost Implications: FAS requires clear communication regarding the exact point alongside the ship where the goods will be delivered, as this is where the risk and costs shift from the seller to the buyer.

Suitability: This term is suitable for buyers who have direct access to ship loading facilities at the port of shipment or who prefer to control the sea transport and loading process.

FAS Incoterm 2020 provides a framework where the seller has fulfilled their obligations once the goods are available alongside the vessel at the specified port, making it a critical term for specific types of sea transport where buyers want to take charge of the loading and onward shipment.

FOB (FREE ON BOARD)

FOB (Free On Board) is one of the Incoterms established by the International Chamber of Commerce (ICC) under the Incoterms 2020 rules, applicable specifically to sea and inland waterway transport. It delineates the responsibilities of buyers and sellers in the shipping process, focusing on the point at which risks and costs transfer from the seller to the buyer.

Key Features of FOB Incoterm 2020:

Seller’s Responsibilities:

Pre-Shipment: The seller must package and label the goods appropriately for export and handle all customs formalities for the exportation of the goods.

Delivery: The seller is responsible for delivering the goods on board the vessel nominated by the buyer at the named port of shipment. The risk passes to the buyer once the goods are on board the vessel.

Costs: The seller bears all costs associated with getting the goods to the port and loading them onto the ship, including pre-carriage and loading charges.

Buyer’s Responsibilities:

Main Carriage: After the goods are on board, the buyer assumes all risks and costs associated with the goods, including the cost of ocean freight, insurance, unloading at the destination port, and any further transportation costs to the final destination.

Import Formalities: The buyer is responsible for import customs clearance and must pay any duties, taxes, and other charges associated with importing the goods.

Usage and Considerations:

Sea and Inland Waterway Only: FOB is intended for use only when goods are transported by sea or inland waterway. For other modes of transport, alternative Incoterms such as FCA (Free Carrier) are more appropriate.

Risk and Cost Transfer Point: It’s crucial to note that the risk and costs transfer from the seller to the buyer once the goods have been loaded onto the vessel. This clear division helps in planning insurance and logistics.

Suitability: FOB is often chosen by buyers who have specific preferences or arrangements for sea transportation and wish to control the freight and insurance from the port of shipment.

FOB Incoterm 2020 is widely used in international trade contracts involving sea transportation, offering a balance of responsibilities between the seller and the buyer. It provides a clear framework for the transfer of risks and costs, making it essential for parties involved in maritime trade to understand and properly implement its provisions.

BUYER VS. SELLER RESPONSIBILITIES INCOTERMS 2020

Creating a comprehensive table to compare buyer and seller responsibilities under all Incoterms 2020 involves summarizing the main obligations for each term. This overview helps to understand the division of responsibilities in international trade transactions.

| Incoterm | Seller’s Responsibilities | Buyer’s Responsibilities |

|---|---|---|

| EXW | Make goods available at their premises. Clear goods for export. | Arrange all transportation. Pay all costs. Clear goods for import. Assume all risks. |

| FCA | Deliver goods to the carrier nominated by the buyer. Clear goods for export. | Arrange main carriage. Pay freight costs. Clear goods for import. Assume risks after delivery to the carrier. |

| FAS | Place goods alongside the ship. Clear goods for export. | Arrange and pay for the main carriage. Load goods on ship. Clear goods for import. Assume all risks after goods are placed alongside the ship. |

| FOB | Load goods on board the vessel. Clear goods for export. | Arrange and pay for the main carriage. Clear goods for import. Assume risks once goods pass the ship’s rail. |

| CFR | Arrange and pay for carriage to the named port. Load on board & clear goods for export. | Pay for unloading. Clear goods for import. Assume risks once goods are loaded on board. |

| CIF | Same as CFR, plus arrange and pay for minimum insurance coverage to the named port. | Pay for unloading. Clear goods for import. Assume risks once goods are loaded on board. Claim under seller’s insurance if necessary. |

| CPT | Arrange and pay for a carriage to the named place. Clear goods for export. | Pay for unloading (if applicable). Clear goods for import. Assume risks once goods are delivered to the first carrier. |

| CIP | Same as CPT, plus arrange and pay for minimum insurance coverage to the named place. | Pay for unloading (if applicable). Clear goods for import. Assume risks once goods are delivered to the first carrier. Claim under seller’s insurance if necessary. |

| DAP | Deliver goods to the named place ready for unloading. Assume all costs and risks to the named place except duties/taxes. | Pay for unloading. Clear goods for import. Assume risks & costs of import duties/taxes. |

| DPU | Deliver and unload goods at the named place. Assume all costs and risks to the named place including unloading. | Pay for import clearance. Assume risks & costs after unloading. Pay import duties/taxes. |

| DDP | Deliver goods ready for unloading at the named place. Assume all risks and costs including import duties/taxes. | Unload goods. Assume risks once goods are made available for unloading. |

This table highlights the distribution of obligations between the seller and buyer under each Incoterm 2020. It’s crucial for parties in international trade to carefully select the most appropriate Incoterm that aligns with their capabilities, needs, and understanding of the risks and costs associated with the transportation and delivery of goods.

THE INTERNATIONAL CHAMBER OF COMMERCE (ICC)

The International Chamber of Commerce (ICC) is the world’s largest and most representative business organization, with over 45 million members in over 100 countries. It spans every sector of private enterprise, providing a voice for businesses at the international level. The ICC works to promote international trade and investment, develop rules that govern international business, and help companies and states settle international disputes. María Fernanda Garza currently chairs the organization, with John W.H. Denton AO serving as the Secretary-General. For more detailed information about the ICC and its initiatives, you can visit their official website: ICC | International Chamber of Commerce

THE ROLE OF ICC

The International Chamber of Commerce (ICC) plays a pivotal role in the global business landscape. Established in 1919, it serves as the world’s largest business organization, with a mission to make business work for everyone, every day, everywhere. The ICC promotes international trade, responsible business conduct, and a global approach to regulation through a unique mix of advocacy, solutions, and standard setting. Here are the key roles and activities of the ICC:

Promotion of International Trade (Advocacy)

The ICC advocates for open international trade and investment, economic growth, and job creation. It works to influence policy and regulatory developments on behalf of businesses, aiming to remove barriers to international trade.

Development of Global Standards

Incoterms® Rules: The ICC publishes the Incoterms rules, which provide internationally recognized standards for the terms of trade between sellers and buyers, reducing or eliminating uncertainties arising from different interpretations of such terms across countries.

Uniform Customs and Practice for Documentary Credits (UCP): It develops and updates standards for international trade financing, including the widely used UCP for letters of credit.

Legal Rules and Arbitration

The ICC International Court of Arbitration is one of the world’s leading arbitration institutions, offering arbitration, mediation, and other dispute resolution services to resolve international commercial and business disputes.

Codes & Guidelines for Trade

The ICC issues various codes and guidelines to promote ethical and sustainable business practices across industries worldwide. These include guidelines on advertising and marketing, anti-corruption, competition, and environmental responsibility.

Capacity Building (Training about Intl. Business Best Practices)

It conducts training sessions, seminars, and events on various aspects of international trade, including trade finance, arbitration, and business law, helping to educate and inform businesses and legal professionals.

Global Influence

The ICC represents business interests at major global policy forums, including the G20, the United Nations, and the World Trade Organization (WTO), ensuring that the voice of business is heard in international policy decision-making processes.

Sustainability and Innovation

The ICC promotes sustainable development, advocates for climate action in line with the Paris Agreement, and supports businesses in transitioning towards a low-carbon economy.

The ICC’s multifaceted role supports the smooth functioning of global commerce, providing a crucial platform for business voices, developing standards that facilitate international trade, and helping resolve disputes that may arise. Through its global network, the ICC fosters an environment conducive to the growth and development of companies in an ethically responsible and sustainable manner.

4 Responses

You explained it very well.

This article was so interesting I learn a lot of new things here thanks for the publisher.

Very help article. All export import condition here.

Thank you for your appreciated comment. Should you need further information on some specific topics, kindly send us an email to support@projectmaterials.com. To submit an RFQ for piping materials, please visit this page: https://projectmaterials.com/submit-rfq-mto. Best regards, Projectmaterials