Shipping Docs: Invoice, B/L, Packing

Common Shipping Documents

Quick Reference

| Category | Key Documents | Who Issues |

|---|---|---|

| Financial | Proforma Invoice, Commercial Invoice, COO | Seller / Chamber of Commerce |

| Insurance | Cargo Insurance Policy | Insurer (buyer or seller per Incoterm) |

| Transport - Sea | Bill of Lading (B/L), House B/L | Carrier / Freight forwarder |

| Transport - Air | Airway Bill (AWB) | Airline |

| Transport - Road | CMR consignment note | Carrier |

| Quality | Third-Party Inspection, MTC | Inspection agency / Manufacturer |

| Regulatory | Export License, REACH, DGD | Government / Authorized body |

Administrative/Financial Documents

Proforma Invoice (“PI”)

A proforma invoice is a preliminary bill of sale sent to buyers before shipment. It’s not a demand for payment-it’s a formal quotation that buyers use to:

| Use | Purpose |

|---|---|

| Open Letters of Credit | Bank requires PI to establish LC amount and terms |

| Obtain import licenses | Some countries require PI before issuing import permits |

| Plan customs duties | Destination customs uses PI to estimate duties/taxes |

| Verify pre-shipment inspection | Inspectors compare goods against PI specifications |

Required elements: Date, seller/buyer details, goods description, quantities, prices, total amount, delivery terms (Incoterms), payment terms, and validity period.

The PI is not legally binding for payment-that comes with the Commercial Invoice after shipment.

Commercial Invoice (“CI”)

The commercial invoice is issued after shipment as the final bill and legal record of the sale. Customs authorities use it to calculate duties and verify compliance.

Required elements:

| Element | Details |

|---|---|

| Parties | Seller and buyer names, addresses, contact details |

| Goods | Description, quantities, weights, packaging |

| Value | Unit prices, total value, currency |

| Terms | Incoterms, payment terms |

| Shipment | Method, date, destination |

| Classification | Country of origin, HS codes |

Inaccurate commercial invoices cause customs delays, penalties, or goods seizure. The CI serves as legal evidence in disputes.

Legalized Invoice and Consular Invoice

Some importing countries-particularly in the Middle East-require commercial invoices to be authenticated by their consulate in the exporting country before goods can clear customs.

| Document | What It Is | Process |

|---|---|---|

| Legalized Invoice | Commercial invoice authenticated by destination country’s consulate | Prepare CI → Notarize locally (if required) → Submit to consulate → Pay fees → Receive stamped document |

| Consular Invoice | Specific form issued by the consulate, filled by exporter, certified by consulate | Request form from consulate → Complete with shipment details → Submit with fee → Receive certified invoice |

Both serve the same purpose: fraud prevention, regulatory compliance, and customs facilitation. The key difference is that a legalized invoice authenticates your existing commercial invoice, while a consular invoice uses a specific form provided by the consulate.

Common destinations requiring legalization: Saudi Arabia, UAE, Qatar, Kuwait, Egypt, and other Arab countries.

Proforma vs. Commercial Invoice

| Aspect | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Timing | Before shipment (quotation stage) | After shipment (billing stage) |

| Legal status | Not legally binding for payment | Legally binding proof of sale |

| Purpose | Open LC, obtain import license, estimate duties | Request payment, customs clearance, accounting |

| Content | Estimated prices and terms | Final, actual transaction details |

| Customs use | Preliminary assessment | Official duty calculation |

Cargo Insurance Policy

Cargo insurance protects goods against loss or damage during transport by land, sea, or air.

| Policy Type | Coverage |

|---|---|

| All Risk | Full coverage-covers all physical loss/damage except specific exclusions |

| With Average (WA) | Covers partial losses from specific perils (sinking, fire, collision) |

| Free of Particular Average (FPA) | Only covers total loss or damage from major events |

Insured value typically includes: goods cost + shipping cost + 10-20% margin.

Who subscribes? Depends on the Incoterm:

- CIF / CIP: Seller must arrange insurance

- Other terms: Buyer typically arranges coverage

Filing a claim requires: original insurance certificate, commercial invoice, packing list, Bill of Lading, and incident report (prepared with the insurance agent and carrier).

Export License

Certain products require government authorization before export-primarily for national security, foreign policy, or non-proliferation reasons.

Products typically requiring export licenses:

| Category | Examples |

|---|---|

| Military items | Weapons, ammunition, military vehicles |

| Dual-use goods | Advanced computing, encryption software, precision machining |

| Controlled chemicals | Precursors for chemical weapons |

| Nuclear materials | Enrichment equipment, nuclear-grade materials |

Application process: Submit product specifications, destination country, end-user identity, and end-use statement. The licensing authority reviews against control lists and sanctions before approval.

Dangerous Goods Declaration (DGD)

Required when shipping hazardous materials by any mode. The DGD informs carriers and handlers of the risks so they can take safety precautions.

Required information:

| Element | Details |

|---|---|

| Identification | Proper shipping name, hazard class, UN number |

| Quantity | Amount and packaging type |

| Packing Group | I (great danger), II (medium), III (minor) |

| Emergency contact | 24-hour contact for incidents |

| Parties | Shipper and consignee names/addresses |

| Certification | Shipper’s signed declaration of compliance |

Applicable regulations: IMDG Code (sea), IATA DGR (air), ADR (road in Europe).

Incomplete or inaccurate DGDs result in shipment rejection, fines, and potential criminal liability if incidents occur.

REACH Certificate

Required for products exported to the EU that contain chemicals subject to REACH regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals).

When required:

| Situation | Threshold |

|---|---|

| Chemical substances imported to EU | ≥1 tonne/year |

| Products containing SVHC (Substances of Very High Concern) | >0.1% w/w concentration |

| Articles with intended chemical release | Any quantity |

Compliance options: Either work with your EU-based importer or appoint an “Only Representative” (OR) in the EU to handle registration.

REACH compliance is mandatory for EU market access-non-compliant shipments face customs rejection.

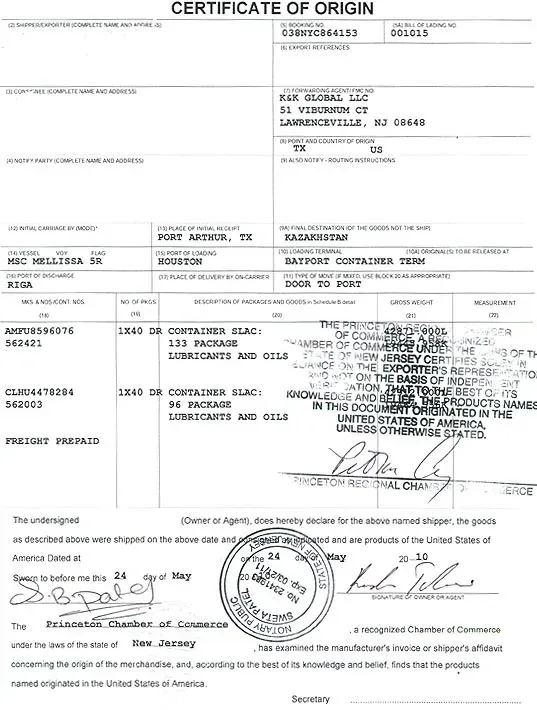

Certificate of Origin (“COO”)

The COO certifies where goods were produced, manufactured, or processed. Customs authorities use it to determine applicable tariffs and verify compliance with import regulations.

| Type | Purpose | Issued Under |

|---|---|---|

| Preferential COO | Qualifies for reduced/zero duties | Free Trade Agreement (FTA) between countries |

| Non-Preferential COO | Standard customs clearance | No FTA-used for quotas, anti-dumping measures |

How to obtain: Apply through your local chamber of commerce or designated government body, providing commercial invoice and goods details. The chamber verifies and stamps the certificate.

False Origin Declarations

| Consequence | Impact |

|---|---|

| Financial penalties | Fines often exceed the duties that would have been paid |

| Goods seizure | Customs confiscates misdeclared shipments |

| Criminal charges | Intentional fraud can result in imprisonment |

| Trading ban | Loss of preferential tariff rights, possible export/import bans |

| Reputational damage | Loss of customer trust and future business |

| Increased scrutiny | More frequent inspections, delays, higher compliance costs |

| Compensation claims | Partners may sue for losses caused by your misdeclaration |

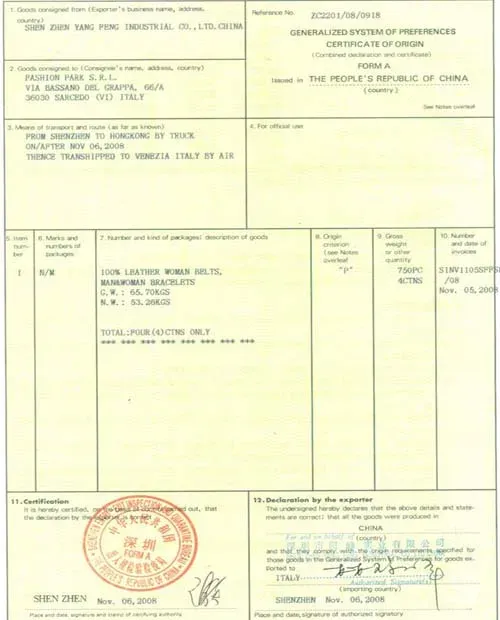

Form-A Certificate of Origin (GSP)

The Form-A is a specific COO used under the Generalized System of Preferences (GSP)-a program allowing reduced/zero tariffs for imports from developing countries into developed markets.

Key points:

- Not all products/countries qualify-check the importing country’s GSP rules

- Apply through your national authority with production details proving origin

- Valid for 10 months from issuance

- List of GSP beneficiary countries

Restricted Destination Statement

A clause in shipping documents or contracts specifying destinations to which goods cannot be shipped due to sanctions, embargoes, or export controls. Including this statement protects all parties from inadvertent sanctions violations.

Export Control Regulations

Export controls regulate the export of sensitive goods, technology, and information for national security and non-proliferation purposes.

International control regimes:

- Wassenaar Arrangement (conventional arms, dual-use)

- Nuclear Suppliers Group

- Missile Technology Control Regime

- Australia Group (chemical/biological)

Currently sanctioned destinations (verify current status before shipping):

| US Sanctions (OFAC/BIS) | EU Sanctions |

|---|---|

| Iran, North Korea, Syria, Cuba | Iran, North Korea, Syria |

| Crimea region | Crimea region, Russia (sectoral) |

| Various entity lists | Various entity lists |

Transportation Documents

Packing List (“PL”)

The packing list details physical shipment information-attached to packages for customs and receiving verification. Unlike the commercial invoice, it contains no pricing.

| Information | Details |

|---|---|

| Quantities | Net weight, gross weight, volume |

| Goods | Description, quality, HS codes |

| Packaging | Type (cases, crates, drums, pallets, containers) |

| Logistics | Shipment date, routing, forwarder |

Fumigation Certificate (Phytosanitary)

Required when using wooden packaging (pallets, crates, boxes) to prevent pest spread across borders.

ISPM 15 standard requires wood packaging to be:

- Heat-treated (HT) to 56°C core temperature for 30 minutes, OR

- Fumigated with methyl bromide

- Marked with the ISPM 15 compliance stamp

Process: Treat wood packaging → Request inspection from national plant protection authority → Receive certificate or compliance stamp.

Timing: Treatment must occur 3-60 days before arrival (varies by country).

Non-compliant shipments face rejection, destruction of packaging, or treatment at importer’s expense.

Delivery Note

Accompanies the shipment for the buyer to verify contents against their order. Does not include pricing. The recipient signs to acknowledge receipt-this signed copy serves as proof of delivery.

Contents: Seller/buyer details, order reference, goods list with quantities, delivery date, handling instructions, signature field.

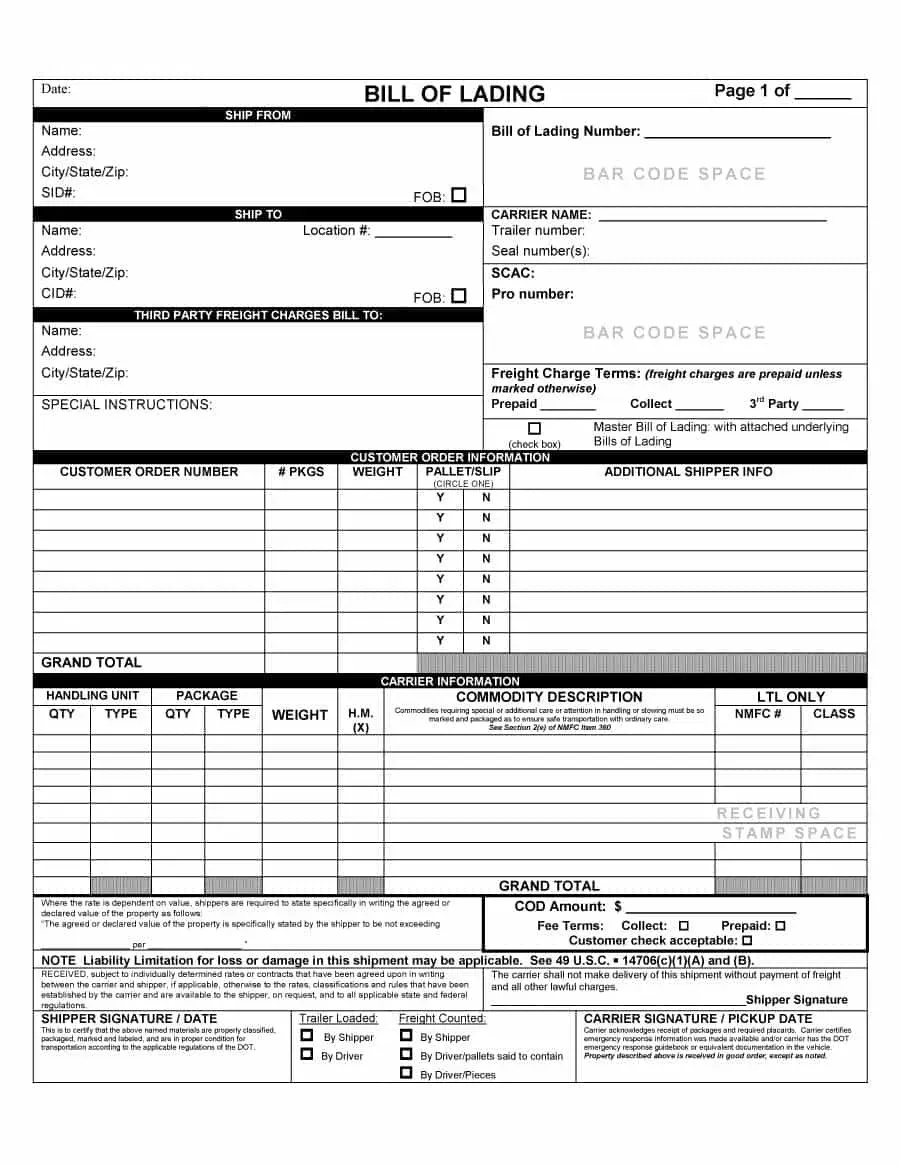

Bill of Lading (B/L)

The B/L is the most important document in ocean freight-it serves three functions simultaneously:

| Function | Description |

|---|---|

| Contract of carriage | Terms under which goods are transported |

| Receipt | Carrier confirms receiving goods as described |

| Document of title | Controls ownership-can be endorsed to transfer goods |

Types of B/L:

| Type | Characteristics |

|---|---|

| Straight B/L | Non-negotiable-goods released only to named consignee |

| Order B/L | Negotiable-ownership transfers by endorsement |

| Clean B/L | No defects noted at loading |

| Claused (Dirty) B/L | Notes defects or discrepancies |

| Through B/L | Covers multiple transport modes |

| Electronic B/L | Digital version (requires all parties to accept) |

Key contents: Consignor/consignee, carrier, goods description, vessel/voyage, ports, freight terms, cargo marks.

Letters of Credit typically require a clean, on-board B/L for payment.

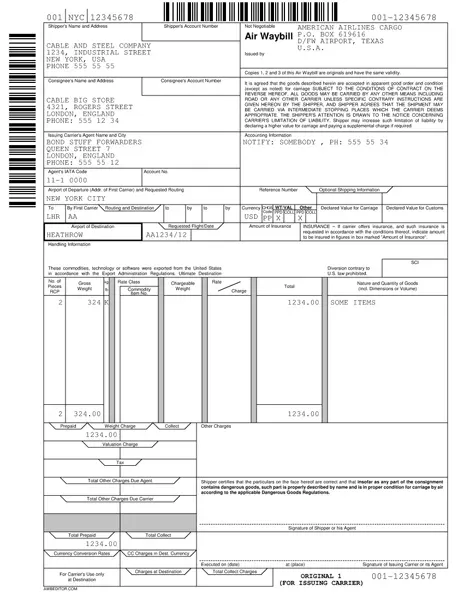

Airway Bill (AWB)

The AWB is the air freight equivalent of the B/L, but with one critical difference: it is non-negotiable and does not transfer title. It’s simply a receipt and contract of carriage.

Contents: Consignee, goods description (quantity/quality), LC-required text if applicable.

House B/L vs. Master B/L

In consolidated shipping, two B/Ls exist simultaneously:

| Document | Issued By | To Whom | Covers |

|---|---|---|---|

| Master B/L (MBL) | Ocean carrier | Freight forwarder / NVOCC | Entire container, port-to-port |

| House B/L (HBL) | Freight forwarder / NVOCC | Individual shipper | Your portion of consolidated cargo |

The shipper deals with the HBL; the forwarder deals with the MBL. Both represent contracts of carriage, but at different levels of the logistics chain.

Multimodal Bill of Lading (FBL)

Also called Combined Transport Document (CTD). Used when goods travel via multiple transport modes (sea + road + rail, etc.) under a single contract.

Key benefit: One contract, one carrier (the Multimodal Transport Operator), single point of accountability-regardless of how many subcontractors handle different legs.

Can serve as document of title (negotiable) like a standard B/L.

CMR (Carriage of Goods by Road)

The CMR consignment note is the standard document for international road transport, primarily in Europe. Based on the 1956 Geneva Convention, it establishes carrier liability for loss, damage, or delay.

Key points:

- Not negotiable-does not transfer title (unlike a B/L)

- Three copies: sender, carrier, receiver (all sign)

- Contents: Parties’ details, goods description, customs instructions, pickup/delivery locations

- Liability: Carrier liable per CMR Convention limits

Frequently required even for Letters of Credit despite being non-negotiable.

International trade requires three categories of documents: financial (invoices, insurance), transportation (Bill of Lading, AWB, CMR), and quality (inspection certificates, MTCs). Missing or incorrect documents cause customs delays, payment holds, and shipment rejections. Always verify document accuracy before shipment; fixing errors after goods are in transit is costly and time-consuming.

Quality Inspection Documents

Third-Party Inspection Certificate

Issued by independent agencies (SGS, DNV, Lloyd’s) to verify quality, quantity, and conformity to standards (ASME, API, EN) or contract requirements.

Types of inspection:

| Type | Timing | Purpose |

|---|---|---|

| Pre-production | Before manufacturing | Verify raw materials and components |

| DUPRO | During production | Monitor quality during manufacturing |

| Pre-shipment | Before dispatch | Most common-random sample inspection |

| Container loading | At containerization | Verify goods match documentation |

| Arrival | At destination port | Final verification (less common) |

Cost: Generally paid by buyer unless contract specifies otherwise.

Certificate of Analysis and Mill Test Certificate

| Document | Used For | Contents |

|---|---|---|

| Certificate of Analysis | Chemical products, raw materials | Composition, acidity, viscosity, moisture, REACH/RoHS compliance |

| Mill Test Certificate (MTC) | Metal products | Chemical composition, mechanical properties (per EN 10204 3.1, 3.2) |

Both verify that materials meet specified standards. MTCs are issued by the manufacturer; Certificates of Analysis typically come from independent laboratories.

Leave a Comment

Have a question or feedback? Send us a message.