Factoring & Forfeiting Explained

Converting Trade Receivables into Cash

Trade receivables are recorded as current assets-they represent future cash flows from credit sales. Efficient receivable management is critical for cash flow, but waiting 30-90+ days for payment can strain working capital.

Options for Early Cash Conversion

| Method | Best For | Recourse | Typical Advance |

|---|---|---|---|

| Factoring | Short-term receivables | With or without | 70-90% |

| Forfaiting | Medium/long-term, large transactions | Without | Up to 100% |

| Invoice discounting | Companies retaining collection control | With | 70-90% |

| Banker’s acceptance | International trade | Bank-guaranteed | Face value at maturity |

| Asset-based lending | Companies with strong receivables | Collateral-based | 70-85% |

| Securitization | Large volumes of receivables | Varies | Varies |

Exporters can convert trade receivables into immediate cash through multiple methods: factoring (sell invoices at discount, 70-90% advance), forfaiting (sell medium/long-term receivables without recourse, up to 100% advance), invoice discounting (borrow against invoices while retaining collection control), or asset-based lending (use receivables as collateral). The right choice depends on transaction size, maturity, and whether credit risk transfer is needed.

Financing Methods in Detail

Factoring

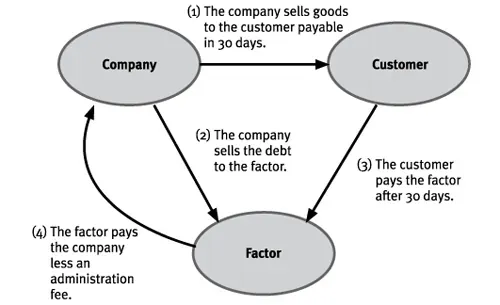

Factoring involves selling invoices to a third party (the factor) at a discount in exchange for immediate cash. The factor advances 70-90% of invoice value upfront and collects payment directly from customers.

How credit factoring works

How credit factoring works

| Aspect | Recourse Factoring | Non-Recourse Factoring |

|---|---|---|

| Credit risk | Seller retains | Factor assumes |

| If customer doesn’t pay | Seller buys back invoice | Factor absorbs loss |

| Cost | Lower fees | Higher fees |

| Best for | Creditworthy customers | Uncertain payment risk |

| Pros | Cons |

|---|---|

| Immediate cash flow | Factor fees reduce margin |

| Outsourced collections | Factor interacts with your customers |

| Scales with sales volume | Can create dependence |

| Non-recourse transfers credit risk | Non-recourse is more expensive |

Credit Forfaiting

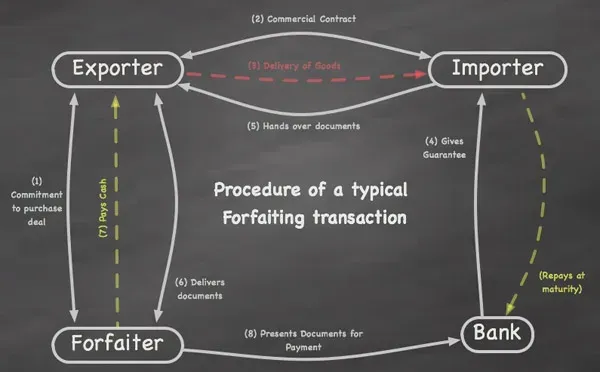

Forfaiting is selling medium-to-long-term trade receivables to a forfaiter (bank or specialized institution) without recourse-the forfaiter assumes all credit, political, and currency risk. Common in international trade for capital goods and large-value transactions.

Credit Forfeiting (Trade Receivables)

Credit Forfeiting (Trade Receivables)

| Feature | Details |

|---|---|

| Recourse | Always non-recourse (forfaiter assumes all risk) |

| Instruments | Bills of exchange, promissory notes, sometimes LCs |

| Guarantee | Usually requires bank guarantee (aval) |

| Advance | Up to 100% of face value |

| Best for | Large international transactions, capital goods |

Factoring vs. Forfaiting

| Aspect | Factoring | Forfaiting |

|---|---|---|

| Receivables maturity | Short-term (30-90 days) | Medium/long-term (180 days to years) |

| Transaction size | Smaller, ordinary goods | Larger, capital goods |

| Advance | 70-90% | Up to 100% |

| Recourse | With or without | Always without |

| Cost bearer | Exporter | Often importer |

| Secondary market | No | Yes (negotiable instruments) |

Invoice Discounting

Invoice discounting allows businesses to borrow against outstanding invoices while retaining control of collections. Unlike factoring, customers don’t know the invoices are financed-the business continues to manage its own sales ledger.

| Feature | Invoice Discounting | Factoring |

|---|---|---|

| Collection | Business collects | Factor collects |

| Customer awareness | Confidential | Customer knows |

| Control | Business retains ledger | Factor takes over |

| Advance | 70-90% | 70-90% |

Best for: Businesses with strong credit control processes wanting confidential financing.

Banker’s Acceptance (BA)

A short-term debt instrument guaranteed by a commercial bank, commonly used in international trade. The bank promises to pay the holder a specified amount at a future date (typically within 6 months).

| Feature | Details |

|---|---|

| Security | Bank-guaranteed payment |

| Liquidity | Can be sold on secondary market at discount |

| Maturity | Typically under 6 months |

| Use | International trade payments |

Asset-Based Lending (ABL)

ABL uses trade receivables as collateral for a loan facility. Unlike factoring, the business retains control of collections and customer relationships.

| Feature | Details |

|---|---|

| Borrowing base | 70-85% of receivables value |

| Scaling | Credit line grows with sales |

| Control | Business retains customer relationships |

| Requirements | Regular reporting on receivables |

Best for: Companies with strong receivables but limited traditional collateral.

Other Methods

| Method | Description |

|---|---|

| Receivables securitization | Pool receivables into an SPV; issue securities to investors. Complex-suited for large organizations. |

| LC collateralization | Use confirmed Letter of Credit as security to obtain financing from own bank. |

Export-Import Banks (Exim)

Exim Banks are government-backed agencies that support exporters with financing, insurance, and guarantees. They fill gaps where private banks won’t assume country or credit risk.

Exim Bank Services

| Service | How It Helps |

|---|---|

| Export credit insurance | Protects against buyer non-payment (commercial or political reasons) |

| Working capital guarantees | Guarantees loans to finance export production |

| Factoring/forfaiting support | Facilitates receivable sales through partner institutions |

| Buyer financing | Direct loans to foreign buyers |

| LC confirmation | Adds bank guarantee to Letters of Credit |

Exim Banks by Country

| Region | Agencies |

|---|---|

| Americas | US Ex-Im Bank, Export Development Canada, Banco Nacional de Comercio Exterior (Mexico) |

| Europe | SACE (Italy), Euler Hermes (Germany), Coface (France), Atradius (Netherlands) |

| Asia | China Exim Bank, NEXI (Japan), EXIM India, K-sure (Korea) |

| Other | EFIC (Australia), SERV (Switzerland), Thai Exim |

Leave a Comment

Have a question or feedback? Send us a message.