Exporters often need to convert their accounts receivable (credits from the sale of goods, equipment, and services) into cash before the actual payment date to maintain cash flow, invest in operations, finance their working capital needs, or expand their business. Several financial instruments and services can facilitate this process, each with its own advantages and considerations: factoring, credit forfeiting, banker’s draft, invoice discounting, asset-based lending (ABL), securitization of receivables, and credit collateralization (example credit from operational Letters of Credit). This article sheds some lights on these alternative options to turn invoices & receivables into cash.

HOW CASH-IN TRADE RECEIVABLES BEFORE EXPIRY

WHAT ARE TRADE RECEIVABLES

Trade receivables, often referred to simply as “receivables,” represent the amounts owed to a company by its customers for goods or services delivered or used on credit but not yet paid for. They are a common feature in business transactions, especially in B2B (business-to-business) environments, where offering credit terms is a standard practice.

Trade receivables are recorded on the balance sheet as current assets because they are expected to be converted into cash within a short period, typically within one year.

Key Aspects of Trade Receivables

Credit Sales: Trade receivables arise from sales where payment is not collected at the point of sale but is instead deferred for a period, typically ranging from 30 to 90 days or more, depending on the credit terms agreed upon between the seller and the buyer.

Invoice Issuance: Upon delivery of goods or completion of services, the seller issues an invoice to the buyer, which details the amount due and the payment terms. This invoice is the basis for recording the trade receivable in the seller’s accounting system.

Asset on Balance Sheet: For the seller, trade receivables are considered assets because they represent future cash flows. When customers pay their invoices, the cash received reduces the amount of trade receivables on the balance sheet.

Management and Collection: Effective management of trade receivables is crucial for maintaining healthy cash flow. Companies may employ various strategies to ensure timely collection, such as offering early payment discounts or implementing rigorous follow-up procedures for overdue accounts.

Risk of Bad Debt: There is a risk that some trade receivables will not be collected, known as bad debt. Companies often estimate and set aside an allowance for doubtful accounts to account for this risk, reflecting a more accurate picture of the expected cash flow from receivables.

Importance in Business

Trade receivables play a significant role in a company’s cash flow management. Efficiently managing receivables can significantly impact a company’s liquidity, operational efficiency, and overall financial health. High levels of receivables may tie up capital that could be used for other operational needs or growth opportunities, whereas too aggressive a collection policy might strain customer relationships.

In summary, trade receivables are an essential component of many businesses’ operations, representing the credit extended to customers. Proper management of trade receivables is vital for ensuring that these short-term financial assets are converted into cash promptly, thereby supporting the company’s cash flow and financial stability.

CASH IS KING

Exporters have multiple options for converting trade receivables into cash, each with its benefits and considerations. The choice of method depends on the exporter’s needs, the relationship with the buyer, the size of the receivables, and the cost of financing. Exporters must evaluate these options carefully and consider consulting with financial advisors to select the most suitable strategy for their specific circumstances.

ALTERNATIVE OPTIONS TO CASH-IN RECEIVABLES BEFORE THE DUE DATE

FACTORING

Factoring of a trade receivable is a financial transaction where a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. This arrangement allows the business to receive immediate cash, which can be used for operational needs, rather than waiting for the payment terms of the invoices to lapse, which could be 30, 60, 90 days, or even longer. Factoring can be a valuable tool for businesses looking to improve cash flow, manage receivables more efficiently, or invest in growth opportunities.

Key Components of Factoring

Immediate Cash Access: The most immediate benefit of factoring is the access it provides to cash. Businesses receive an advance, which is a percentage of the invoice value, typically ranging from 70% to 90%, depending on the agreement with the factor.

Credit Risk Management: In non-recourse factoring, the factor assumes the credit risk associated with the accounts receivable. This means if a customer fails to pay the invoice, the factor bears the loss, not the business that sold the invoice.

Outsourced Collections: Factoring companies usually take over the management and collection of the factored invoices. This can reduce the administrative burden on businesses, allowing them to focus on their core operations instead of chasing payments.

Fees and Charges: The factor charges fees for their services, which can vary based on the volume of receivables, the risk profile of the customers, and the terms of the agreement. The fees are deducted from the remaining invoice amount (the portion not advanced) when it is collected from the customer.

Types of Factoring

Recourse Factoring: The business selling the invoices retains the risk of non-payment by the customers. If an invoice is not paid, the business must buy it back from the Factor.

Non-Recourse Factoring: The factor assumes the risk of non-payment, offering businesses greater protection against bad debts. This type is often more expensive due to the additional risk taken on by the factor.

Advantages of Factoring

- Improves cash flow by providing immediate funds from sales.

- Reduces the burden of debt collection and accounts receivable management.

- Helps businesses manage credit risk, especially with non-recourse factoring.

- Can be a flexible financing solution that grows with the business’s sales volume.

Considerations

- Cost: The fees associated with factoring can be higher than traditional financing options.

- Customer Interaction: Factors taking over the collection process mean they will interact with your customers, which could impact customer relationships.

- Dependence: Relying heavily on factoring for cash flow management can make businesses vulnerable to changes in factoring agreements or fees.

Factoring can be an effective financial strategy for businesses needing to improve liquidity and manage receivables more efficiently. However, it’s important to consider the costs and to choose a reputable factor that aligns with the business’s values, especially regarding customer interactions.

The illustration below shows how factoring works:

CREDIT FORFEITING

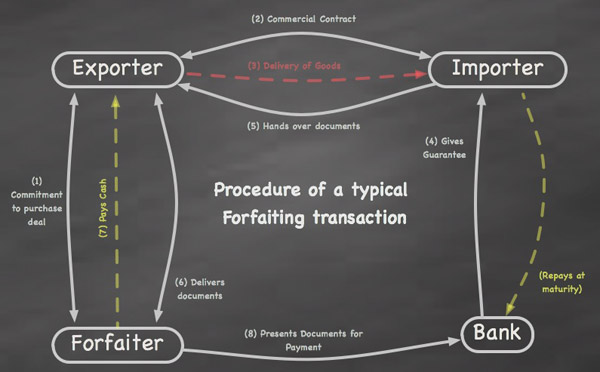

Credit forfeiting (or simply “forfeiting”) is a financial transaction that allows exporters to turn their trade receivables into cash by selling them at a discount to a forfaiter, typically a bank or a specialized financial institution. This method is particularly common in international trade and involves medium to long-term receivables arising from the sale of goods and services. Unlike factoring, forfaiting usually deals with larger transaction volumes and longer payment terms, and it is almost always without recourse to the seller, meaning the financial risk of non-payment by the buyer is transferred to the forfaiter.

Key Features of Forfaiting

Non-Recourse: One of the primary characteristics of forfeiting is that it is a non-recourse sale of receivables. This means that the exporter (seller) is not liable if the importer (buyer) fails to pay the debt. The forfaiter assumes all the risk of credit and default.

Negotiable Instruments: Forfaiting typically involves negotiable instruments such as bills of exchange, promissory notes, and sometimes letters of credit. These instruments are guaranteed by the importer’s bank, providing an additional layer of security.

Financing Cost: The cost of forfeiting is determined by the discount rate applied by the forfaiter to the face value of the receivables. This rate is influenced by various factors, including the creditworthiness of the guarantor (often the importer’s bank), the political and economic risk of the importer’s country, the currency of the transaction, and global interest rates.

International Trade: Forfaiting is predominantly used in international trade transactions to provide liquidity to exporters and mitigate the risks associated with cross-border transactions, such as exchange rate fluctuations, political instability, and the creditworthiness of foreign buyers.

Advantages of Forfaiting

Improves Cash Flow: Exporters receive immediate cash, which can be used for further production, expansion, or debt repayment, without waiting for the buyer to pay at a future date.

Risk Mitigation: Forfaiting transfers the risks of non-payment, political, and exchange rate fluctuations to the forfaiter, allowing exporters to conduct business in riskier markets with greater confidence.

Simplicity and Convenience: The process simplifies the exporter’s credit management and collection efforts, as the forfaiter takes over the responsibility for collecting the payment.

Considerations

Cost: The discount rate and fees forfeiting can be significant, reducing the overall profit margin from the sales transaction.

Availability: Forfaiting may not be available for all types of goods, services, or markets, and typically requires the involvement of banks or financial institutions that offer this service.

Impact on Prices: The cost of forfeiting might lead exporters to increase their sales prices to cover the financing costs, potentially affecting competitiveness.

Forfaiting offers a practical solution for exporters looking to eliminate the financial and political risks associated with international trade receivables. By understanding its features, costs, and benefits, exporters can make informed decisions about using forfeiting as part of their financial strategy.

Difference Between Factoring vs. Credit Forfeiting

| FACTORING | FORFAITING | |

|---|---|---|

| Meaning | Factoring is an arrangement that converts a receivable into ready cash before the due date. Exporter sells the receivable to a factor. | Forfaiting implies a transaction in which the forfaiter purchases a credit claim from an exporter in exchange for a discounted cash payment. |

| Receivables maturity | Short-term receivables | Medium to long-term receivables |

| Goods | Ordinary goods | Capital goods of substantial value |

| Anticipated value | max 80% | Up to 100% |

| Type | With or without the right of recourse | Always without recourse |

| Cost | Exporter | Importer |

| Negotiable? | No | Yes |

| Secondary market | Not possible | Yes |

INVOICE DISCOUNTING

Invoice discounting is a financial practice that allows businesses to borrow money against the value of their outstanding invoices from customers. This type of short-term borrowing is used to improve a company’s working capital and cash flow position. In essence, businesses use their unpaid sales invoices as collateral to secure a loan, without waiting for their customers to pay within the usual terms, which could be 30, 60, 90 days or more.

Key Characteristics of Invoice Discounting

Immediate Cash Flow: Businesses receive an advance from the lender, which is a percentage of the invoice value, typically between 70% to 90%. This provides immediate liquidity to meet operational expenses or invest in growth opportunities.

Confidentiality: One of the key features of invoice discounting is that it can be arranged confidentially, meaning the customers are not aware that the invoices have been financed. The business continues to manage its sales ledger and collects payments from customers as usual.

Control Over Accounts Receivable: Unlike factoring, where the finance company takes over the collection of debts, invoice discounting allows businesses to retain control over their own debtor ledger. They are responsible for pursuing and collecting outstanding invoice payments from their customers.

Advantages of Invoice Discounting

Improved Cash Flow: It provides immediate access to funds tied up in outstanding invoices, enhancing the company’s liquidity and enabling it to manage cash flow more effectively.

Discretion: Since the arrangement can be confidential, businesses can maintain their customer relationships without disclosing the use of their invoices for financing purposes.

Flexibility: It offers flexible funding that increases with the business’s sales. The more sales a business makes, the more funding it can potentially access through invoice discounting.

Considerations

Costs: Invoice discounting involves fees and interest rates that can vary based on the volume of receivables, the risk profile of the debtors, and the terms of the agreement. Businesses need to consider these costs when evaluating the benefits of this financing option.

Eligibility: Not all businesses are eligible for invoice discounting. Lenders typically require a certain turnover level, a proven track record of operations, and a healthy spread of customers.

Risk of Overdependence: Relying heavily on invoice discounting can expose a business to risks if its sales volume decreases or if it experiences significant changes in payment behaviors from customers.

Invoice discounting is a valuable tool for businesses that need to enhance their cash flow quickly without the need to wait for their customers to pay their invoices. It suits businesses with strong credit control processes and a stable customer base. However, businesses must weigh the costs and benefits and consider the potential impact on their financial health and customer relationships.

BANKER’S ACCEPTANCE

A supplier may accept a Banker’s Acceptance as payment from a client; the supplier can hold the banker’s acceptance until expiry or sell it on the secondary market at a discount to convert it into cash before the due date.

A banker’s acceptance is essentially a short-term debt instrument issued by a company while guaranteed by a commercial bank. It is most commonly used in international trade.

A Bank Acceptance operates as a promise that the bank will pay the holder a specified amount at a future date, typically within six months. When a company wants to purchase goods from an overseas supplier, it might use a BA as payment. The supplier can then hold onto the BA until maturity or sell it on the discount market to get immediate cash.

Key Characteristics of Banker’s Acceptance:

- Used in International Trade: Facilitates trade by providing a secure, bank-guaranteed payment method.

- Discounted Instrument: Sold at a discount to its face value and redeemed at full face value at maturity, the difference representing the interest.

- Liquidity: Highly liquid and often seen as a safe investment, especially since it is backed by the guarantee of a reputable bank.

ASSET-BASED LENDING (“ABL”)

Asset-based lending (ABL) is a type of financing where businesses secure loans by using their assets as collateral. When it comes to financing trade receivables, ABL can provide a flexible and efficient source of working capital for businesses. This form of lending is particularly attractive to companies with strong trade receivables but perhaps not enough traditional collateral (like real estate or equipment) or those that do not qualify for unsecured bank loans due to their credit profile.

How Asset-Based Lending Works with Trade Receivables

In the context of trade receivables, a business uses its outstanding invoices (i.e., the money owed by its customers) as collateral to secure a loan. The lender evaluates the quality and reliability of these receivables to determine the borrowing base, which is the maximum amount the company can borrow at any given time. The borrowing base is typically a percentage of the value of the receivables, often ranging from 70% to 85%, depending on the lender’s assessment of the risk involved.

Key Features of Asset-Based Lending for Trade Receivables

- Flexibility: ABL facilities can scale with a company’s growth. As the business generates more sales and hence more receivables, it can potentially access more credit.

- Speed of Access: Once the facility is set up, companies can quickly draw down funds as needed, providing liquidity to meet operational expenses or capitalize on growth opportunities.

- Risk Management: Lenders focus on the quality of the collateral (the receivables) rather than just the creditworthiness of the borrower. This can make ABL a viable option for companies in turnaround situations or with less-than-perfect credit histories.

Advantages

- Improved Cash Flow: ABL provides immediate access to funds, improving cash flow and liquidity without having to wait for customers to pay their invoices.

- Cost-Effective: For companies with a strong base of receivables, ABL can be more cost-effective than other types of financing, such as factoring, where fees can be higher.

- Retention of Control: Unlike factoring, where the factor typically takes over the collection of receivables, with ABL, the business retains control over its sales ledger and customer relationships.

Considerations

- Due Diligence and Monitoring: Lenders will conduct initial due diligence on the receivables and may require regular reporting to monitor the collateral’s value. This can increase the administrative burden on the borrower.

- Costs and Fees: While potentially more cost-effective than other financing options, ABL facilities still involve costs and fees, including interest on the borrowed amounts and possibly charges for facility setup and maintenance.

- Risk of Overreliance: Businesses need to manage the risk of becoming overly reliant on borrowing against receivables, ensuring they have strategies in place to manage their debt levels and maintain healthy cash flow from operations.

Asset-based lending offers a strategic financing solution for businesses looking to leverage their trade receivables for immediate working capital. By understanding the features, advantages, and considerations of ABL, companies can make informed decisions on how best to finance their operations and growth.

RECEIVABLES SECURITIZATION

Securitization involves pooling various financial assets, including trade receivables, and selling them to a special purpose vehicle (SPV), which then issues securities backed by these assets. Investors purchase these securities, providing the exporter with upfront cash. This method is more complex and typically used by larger organizations with significant volumes of receivables.

COLLATERALIZATION OF LETTERS OF CREDIT AND/OR GUARANTEES

While not direct methods for turning receivables into cash, letters of credit (LCs) and bank guarantees provide a guarantee of payment from the buyer’s bank to the exporter. This assurance can make it easier for exporters to obtain financing from their own banks against the promise of future payment under the LC or guarantee.

EXIM BANKS

What are Exim Banks

Export-import (Exim) Banks play a crucial role in facilitating international trade by providing financial products and services that help companies finance their export and import activities.

When it comes to financing trade receivables, Exim Banks offers several solutions to help exporters turn their receivables into cash, thereby improving their cash flow and enabling them to continue their operations without interruption. These solutions are particularly beneficial for exporters facing long payment terms or dealing with buyers in markets where payment risks are higher.

Ways Exim Bank Can Help Finance Trade Receivables:

1. Export Credit Insurance

Exim Banks provide export credit insurance that protects exporters against the risk of non-payment by foreign buyers due to commercial reasons (like bankruptcy) or political unrest in the buyer’s country. With this insurance, exporters can feel more secure in extending credit terms to their buyers. Additionally, having insured receivables can make it easier for exporters to obtain financing from commercial lenders, as the insurance mitigates the lender’s risk of non-payment.

2. Working Capital Guarantee Programs

These programs offer guarantees to lenders, encouraging them to provide loans to exporters by mitigating the risk associated with the financing. Under a working capital guarantee, the Exim Bank guarantees repayment of a loan that the exporter takes out to finance their receivables or to cover the costs of manufacturing goods for export. This guarantee makes it more likely for exporters to obtain attractive borrowing terms.

3. Factoring and Forfaiting Support

Some Exim Banks may offer or facilitate factoring and forfeiting services, where exporters can sell their short-term foreign accounts receivable to a factoring house or forfaiter at a discount in exchange for immediate cash. These services can include non-recourse options, removing the credit risk from the exporter and placing it on the Exim Bank or third-party forfaiter.

4. Direct Lending and Buyer Financing

In some cases, Exim Banks provide direct loans to foreign buyers of goods and services from the exporter’s country or guarantee loans provided by commercial banks. By financing the purchase, Exim Banks help ensure that exporters receive payment for their goods and services promptly, effectively turning the trade receivables into immediate cash for the exporter.

5. Letters of Credit

Exim Banks may also issue or confirm letters of credit, which are guarantees of payment to the exporter provided by the bank. A letter of credit ensures that the exporter will receive payment as long as they comply with the terms and conditions of the letter of credit, providing a high level of security in international trade transactions.

Benefits of Exim Bank Financing for Trade Receivables:

- Improved Cash Flow: By financing trade receivables, exporters can improve their cash flow, enabling them to reinvest in their business, cover operational costs, and take on new orders without waiting for payments.

- Risk Mitigation: Exim Banks provide a safety net against commercial and political risks, allowing exporters to expand into new markets with confidence.

- Competitive Advantage: Access to financing can make an exporter more competitive by enabling them to offer better credit terms to their buyers.

Exim Banks play a vital role in supporting exporters by providing a range of financial instruments and services designed to facilitate the conversion of trade receivables into cash, mitigate risks associated with international trade, and ultimately support the growth and sustainability of exporters in the global market.

American Exim Banks

The Export-Import Bank is the official export credit agency of the United States. Ex-Im Bank helps American companies to turn export opportunities into sales and consequently sustain the US employment and production levels.

The US Ex-Im Bank is not in competition with the private banking sector, rather it complements it by providing export facilities that would not be otherwise available for some companies. It assumes credit and country risks that the private sector is unwilling to support.

The support given by the Ex-Im Bank can range from working capital guarantees (before the export) to credit insurance and/or loan guarantees up to actual loans (financing the buyer). The bank can support any transaction size.

Non-US Exim Banks

Most economies have similar agencies, to support the exporting activities of local businesses. We list here the main agencies, click on the link to be redirected to the official website of the Exim bank or agency.

- Australia: Export Finance and Insurance Corporation

- Belgium: Office National du Ducroire

- Bermuda: Sovereign Risk Insurance Ltd.

- Canada: Export Development Canada (EDC)

- China: China Exim Bank

- Czech Republic: Export Guarantee and Insurance Corporation

- Denmark: Eksport Kredit Fonden

- Finland: Finnvera Plc

- France: Compagnie Francaise d’Assurance pour le Commerce Exterieur

- Germany: Euler Hermes Kreditversicherungs-AG

- Greece: Export Credit Insurance Organization (ECIO)[OECD]

- Hong Kong: Hong Kong Export Credit Insurance Corporation

- Hungary: Hungarian Export Credit Insurance Ltd.

- India: Export-Import Bank of India

- Italy: Servizi Assicurativi del Commercio Estero

- Jamaica: National Export-Import Bank of Jamaica Ltd

- Japan: Nippon Export and Investment Insurance

- Korea: Korean Export Insurance Corp.

- Luxembourg: Office du Ducroire [OECD]

- Malaysia: Export-Import Bank of Malaysia Berhad

- Mexico: Banco Nacional de Comercio Exterior

- Netherlands: Atradius

- New Zealand: Export Credit Office [OECD]

- Norway: Garanti-Instituttet for Eksporkreditt

- Poland: Export Credit Insurance Corporation

- Portugal: Companhia de Seguro de Creditos, S.A.

- Romania: Eximbank Romania

- Singapore: ECICS Credit Insurance Ltd.

- Slovak Republic: Export-Import Bank of Slovak Republic

- Slovenia: Slovene Export Corporation Inc.

- South Africa: Credit Guarantee Insurance Corporation of Africa Limited

- Spain: Compania Espanola de Seguros de Credito a la Exportacion, S.A.

- Sri Lanka: Sri Lanka Export Credit Insurance Corporation

- Sweden: Exportkreditnamnden

- Sweden: Swedish Export Credit Corporation (SEK)

- Switzerland:Swiss Export Risk Guarantee

- Thailand: Export Import Bank of Thailand

- Turkey: Export Credit Bank of Turkey

- Ukraine: Export-Import Bank of Ukraine

- United Kingdom: Export Credits Guarantee Department

- United States: Export-Import Bank of the United States