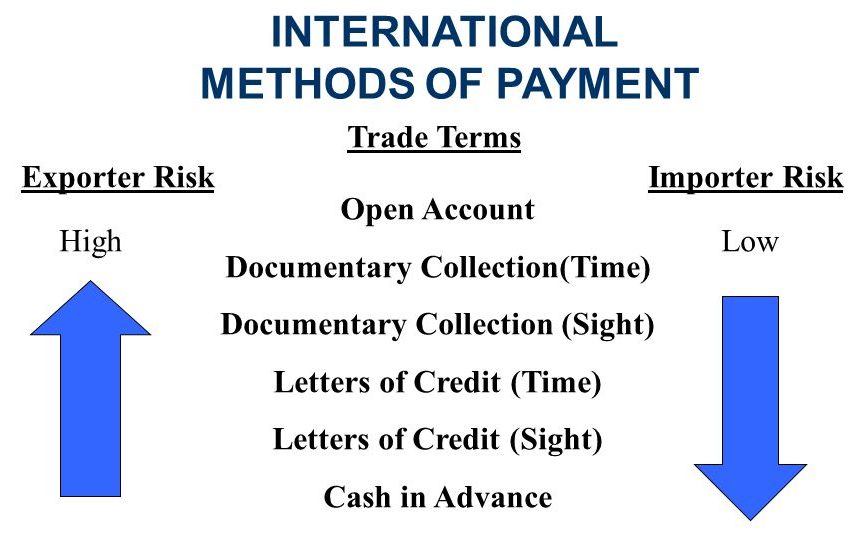

The article examines various payment terms sellers can offer their clients, including “open account” (where goods are delivered before payment is made), “documentary collections” (involving banks to facilitate the exchange of payment and documents representing the goods), “letters of credit,” and “cash in advance.” Each of these methods allocates the risk associated with payment and delivery differently between the exporter and importer (or the seller and the buyer).

TYPES OF PAYMENT TERMS IN CONTRACTS

Let’s explore the various payment terms that buyers and sellers can negotiate and finalize when establishing sales and purchase agreements for goods and/or project equipment.

CASH IN ADVANCE (“AC”)

What is Cash-in-Advance

Cash in advance represents a highly secure payment term for sellers but poses the greatest risk for buyers. Under this arrangement, the seller only dispatches the goods after receiving full (or partial) upfront payment from the buyer. Transactions typically occur via wire transfer or company checks (in the US).

Within the project materials industry (products, materials, and equipment for projects), cash-in-advance terms are uncommon and generally reserved for stock products, expedited deliveries, or unique situations necessitating urgent maintenance, such as unexpected breakdowns or failures.

What does “TT Payment” Mean?

TT payment stands for “Telegraphic Transfer payment”, a method of electronic funds transfer from one person or institution to another. It is commonly used in international trade for sending money between banks across different countries. The term “telegraphic transfer” originates from the time when communication between banks was facilitated via telegraph wires, but in today’s context, it refers to electronic, wire transfers.

For most countries and banks, as a payer confirms a transfer, the funds cannot be recovered from the beneficiary (i.e. payments are irrevocable). ACH payments may be an exception, i.e. they can be revoked.

TT payments are favored in international trade due to their speed and efficiency, allowing businesses to quickly settle payments for goods and services across borders. However, because the funds are transferred before the goods or services are delivered, this method is generally more favorable to sellers, exposing buyers to the risk of non-delivery. To mitigate these risks, buyers and sellers often rely on agreements or use secure payment terms alongside methods like Letters of Credit (LC) or after establishing a trustworthy relationship.

How Buyer Can Mitigate Risks in Case of CA Terms

Propose a 2-step Payment (Advance+Balance at Shipping)

This payment condition modifies the Cash-in-Advance option previously discussed, offering a more equitable arrangement for both transaction participants.

The “Downpayment + Balance at Shipping” payment term involves a two-step financial arrangement between the buyer and seller within the context of a sales and purchase agreement for goods. Under this payment structure:

Downpayment: The buyer makes an initial payment upfront upon signing the contract or placing the order. This downpayment, typically a percentage of the total purchase price, serves as a commitment to the purchase and provides the seller with working capital to begin production or prepare the goods for shipment. Usual percentages range between 20 and 30% of the contract value.

Balance at Shipping: The remaining balance is paid by the buyer at the time the goods are shipped or ready for dispatch. The seller may provide proof of shipment, such as a bill of lading or shipping invoice, as a condition for receiving the final payment.

Key Aspects:

- Security for Sellers: The downpayment secures the seller against potential order cancellations and covers part of the production or procurement costs.

- Cash Flow Management: This term helps both parties manage their cash flows. Sellers receive funds to cover initial costs, while buyers can delay full payment until the goods are on their way.

- Risk Allocation: Risk is shared between the buyer and seller. The buyer risks the downpayment if the goods are not shipped, while the seller risks the balance if they fail to meet the terms for shipping.

- Flexibility: The specific percentages for downpayment and the timing for the balance payment can be negotiated based on the buyer’s financial situation, the seller’s cost structure, and the nature of the goods or services being traded.

This payment term is often used in international trade and manufacturing industries, where the production or procurement of goods involves significant upfront costs. It strikes a balance between providing security to the seller and offering payment flexibility to the buyer.

Ask for an “Advance Payment Guarantee” from the Seller

An Advance Payment Guarantee is a financial instrument used to mitigate the risks associated with cash-in-advance payment terms, especially for the buyer. Under cash-in-advance terms, the buyer pays the seller a portion of the cost before the goods or services are delivered, which poses a risk to the buyer if the seller fails to fulfill their part of the contract. To protect against this risk, an Advance Payment Guarantee is issued by a bank or financial institution on behalf of the seller to the buyer.

Key Features of an Advance Payment Guarantee:

Security for the Buyer: It provides a form of security to the buyer, ensuring that the advance payment can be recovered if the seller does not meet the contractual obligations, such as failing to deliver the goods or services as agreed.

Confidence for the Seller: For the seller, having an Advance Payment Guarantee can make offering cash-in-advance terms more attractive to buyers, as it diminishes the buyer’s perceived risk, potentially facilitating faster agreement on the terms of sale.

Bank or Financial Institution Involvement: The guarantee is provided by a reputable bank or financial institution, which assesses the risk and credibility of the seller before issuing the guarantee.

Conditions for Claiming: The guarantee includes specific conditions under which the buyer can claim a refund of the advance payment. These conditions are typically aligned with the failure of the seller to meet their contractual obligations.

Cost: The seller usually incurs a fee for obtaining an Advance Payment Guarantee, which might be considered in the pricing of the goods or services.

Negotiable Terms: The amount covered by the guarantee, its validity period, and specific terms can be negotiated between the seller, the buyer, and the issuing institution to suit the particular needs of the transaction.

OPEN ACCOUNT

What is Open Account

The “open account” payment term stands in stark contrast to the “Cash-in-Advance” option, as it places the entirety of the risk on the seller’s shoulders. In this arrangement, the supplier dispatches goods to the buyer without any initial payment, with the agreement that payment will be made at a future date (15, 30, 60, 90 days, or beyond). The payment structure may be a lump sum at the due date or in scheduled installments.

Typically, “open account” terms are more likely to be adopted by suppliers who have less bargaining power in comparison to their clients (such as a medium-sized standard product manufacturer dealing with a large, well-known EPC Contractor) or by those suppliers who have a longstanding, trustworthy relationship with a buyer, characterized by a track record of prompt payments (indicating a low risk of default).

To incentivize early payments, suppliers may offer discounts on the total invoice amount, which can be applied directly to the sales invoice if payments are made ahead of schedule.

How Seller Can Mitigate Risks in Case of Open Account

Subscribe to a Credit Insurance?

Credit insurance is designed to protect sellers from the financial risk of non-payment by buyers, typically in the context of trade credit extended under terms like open account transactions. By safeguarding sellers against the inability of their buyers to pay due to insolvency, default, or political risks (in international trade), credit insurance can indeed offer significant protection. However, the extent of this protection and its effectiveness depend on several factors:

Coverage Scope

Credit insurance policies vary in terms of what they cover. Comprehensive policies might protect against a wide range of risks, including insolvency, protracted default, and political risks, while more basic policies may offer limited coverage. The specific risks covered and the percentage of the invoice value insured are crucial determinants of the level of protection provided.

Policy Limits and Exclusions

Policies often come with certain limits and exclusions. There might be caps on the amount payable under the policy or specific buyer risks that are not covered. Understanding these details is essential for sellers to assess how much protection a policy truly offers.

Cost vs. Benefit

The cost of credit insurance premiums needs to be weighed against the benefits of coverage. For some businesses, the cost of insurance can be a significant expense, so it’s important to analyze whether the level of risk justifies the cost.

Diligence Requirements

Credit insurers often require sellers to adhere to specific due diligence procedures and credit management practices. Failure to comply with these requirements might void the coverage. Sellers need to be diligent in their credit management and in following the insurer’s procedures to ensure they remain protected.

Claim Process

The process of filing a claim and receiving payment can be complex and time-consuming. Sellers should be prepared for this process and understand the insurer’s requirements for filing a claim, including any deadlines and documentation requirements.

Enhancing Business Confidence

Beyond financial protection, having credit insurance can enhance a seller’s confidence in expanding to new markets or extending more generous credit terms to buyers, knowing that they are protected against certain losses.

Conclusion

Credit insurance primarily acts as a safety net for sellers against the financial impact of their clients’ bankruptcy, stepping in to cover losses from such defaults. However, it typically does not provide coverage for situations where the buyer refuses payment due to disputes over the delivery or other reasons. In instances of a contested delivery or dissatisfaction with goods, the responsibility falls on the seller to seek legal resolution rather than relying on credit insurance for compensation. Essentially, while credit insurance offers a layer of protection against severe financial losses from client insolvency, it doesn’t absolve sellers from the challenges of payment disputes and the need for legal recourse to enforce payment agreements.

Propose a 2-step Payment (Advance+Balance at/after Shipping)

The seller might propose that a fraction of the payment be made at the onset of the contract rather than deferring all payments until after delivery. This approach is especially reasonable and justifiable when dealing with “bespoke goods,” where custom specifications necessitate a commitment from both parties. Such an arrangement should be deemed equitable and acceptable by the buyer as well.

When the buyer consents to make an upfront payment, the seller’s risk is confined to the segment of the contract’s value that surpasses the initial down payment received. This ensures that both parties share in the commitment and risk associated with the production and delivery of custom-made goods.

Request a more protective payment term, such as documentary credit or Letter of Credit

The seller has the option to propose more favorable payment terms to the buyer than those typically offered under an open account, especially in situations that warrant such adjustments. However, this strategy may only be effective under specific conditions, and securing approval for these terms from EPC contractors, end-users, and other large buyers often presents a challenge. The likelihood of acceptance by such entities is generally low due to their established purchasing policies and bargaining power.

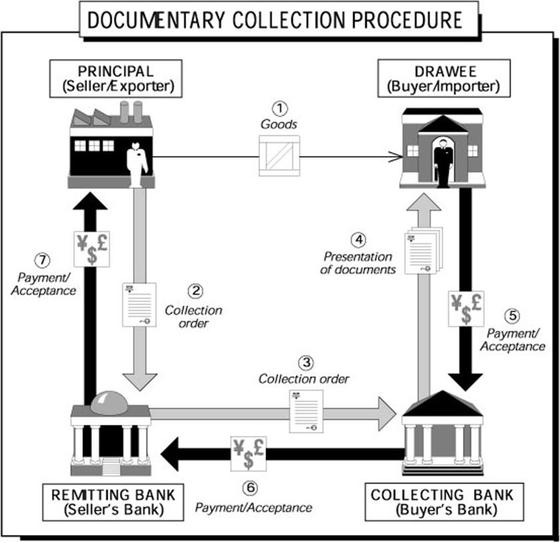

DOCUMENTARY COLLECTION: D/P (CAD) & D/A

What is Documentary Collection

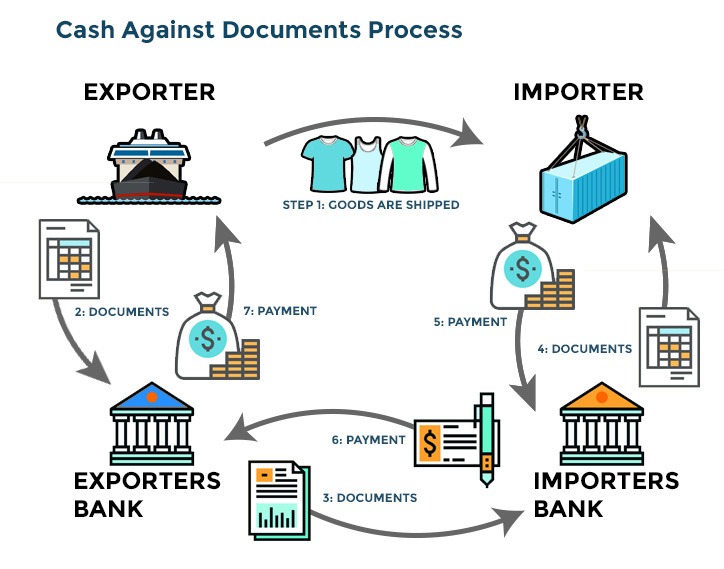

Documentary Collection is a payment mechanism in international trade facilitated by banks, where the exporter’s bank collects payment from the importer’s bank in exchange for documents necessary for the importer to obtain the goods from the carrier.

It’s a method that offers a compromise between the seller’s and buyer’s preferences for payment and document transfer, sitting between the risk levels of open account and advance payment or letter of credit transactions. There are two main types of documentary collection terms:

- Documents against Payment (D/P), otherwise called “CAD”, and

- Documents against Acceptance (D/A)

Documents against Payment (D/P)

Under D/P terms, the importer (buyer) is required to pay the amount due upon the presentation of the documents needed to claim the goods. The documents are only released to the buyer once payment is made. This method provides the exporter with a higher level of security than an open account, as the goods are shipped but not released to the buyer until payment is received. However, it still carries some risk for the seller if the buyer decides not to accept or pay for the goods.

Cash-Against-Documents (CAD)

The term CAD is a synonym of the D/P Documentary collection explained above, and not a different arrangement. Essentially, CAD is synonymous with the D/P (Documents Against Payment) method, emphasizing the requirement for the buyer to pay before receiving the documents and the goods (via the intermediation of banks).

Documents against Acceptance (D/A)

With D/A terms, the documents necessary for the importer to take possession of the goods are released upon the buyer’s acceptance of a time draft. This acceptance signifies the buyer’s obligation to pay at a later date, agreed upon in the sales contract (e.g., 30, 60, 90 days after document acceptance or goods arrival). This arrangement shifts more risk to the seller, as the goods are released to the buyer before payment is made, relying on the buyer’s commitment to pay at the agreed future date.

Documentary Collection (D/P & D/A) Workflow

This type of payment works in this way:

- The seller ships the goods to the buyer

- The seller submits the shipping documents and a “collection order” to its bank (“Remitting bank”) at the time of shipping. The draft includes instructions to release the documents to the buyer upon receipt of a buyer’s payment (D/P) or buyer’s acceptance of the draft (D/A, which can be at sight, demanding payment on presentation, or deferred at a future date)

- The Remitting bank sends the documents, the draft, and the collection instructions to the “Collecting or presenting bank” (the bank of the importer)

- The collecting bank carries out the seller’s collection order and, upon receipt of payment from the buyer, or their acceptance, remits payment to the seller’s bank and to the seller, ultimately

Documents to be Submitted under Documentary Collection

The shipping documents mentioned under Documentary Collection terms include, generally, the commercial invoice, the packing list, the mill test certificates or inspection documents, the bill of lading, the insurance certificate, and any other possible shipping/administrative/fiscal document agreed in the contract.

Learn more about possible shipping documents.

Key Risk for Seller

The primary risk associated with Documentary Collection (D/P, CAD, and D/A) payment terms is the potential for the buyer to choose not to collect the goods and the associated shipping documents after the shipment has been made. This decision can be made arbitrarily, leaving the seller with the challenge of handling unclaimed goods (perhaps at remote overseas locations, like Ports, with the associate demurrage costs).

This scenario contrasts sharply with payment through a Letter of Credit (LC), where the seller faces virtually no payment risk as long as compliant documents are presented to the issuing bank within the credit’s validity period. The LC provides a guarantee of payment from the buyer’s bank, provided the seller meets all the terms and conditions specified in the LC. This financial instrument significantly reduces the seller’s risk of non-payment.

Given these considerations, sellers must exercise caution when agreeing to Documentary Collection payment terms, as they carry notable risks not present with LC transactions. The decision to use DC terms should be weighed against the reliability and trustworthiness of the buyer, as well as the seller’s capacity to manage the risks involved.

Conclusions on DC Terms

- Risk Level: D/P offers more security to the seller since payment is required for the buyer to obtain the goods. D/A involves more risk for the seller, as it relies on the buyer’s promise to pay in the future.

- Cash Flow Impact: D/P can strain the buyer’s cash flow, as it requires immediate payment. D/A provides some cash flow relief to the buyer, allowing for payment deferment.

- Control Over Goods: In D/P, the control over goods remains with the seller until payment is made. In D/A, control is transferred to the buyer upon accepting the draft, before payment.

Documentary Collection, whether D/P or D/A, serves as a middle ground, balancing the interests and risks of exporters and importers. It streamlines the payment process while providing certain assurances to both parties. However, the choice between D/P and D/A will depend on the trust level between the trading partners, the negotiation power, and the risk appetite of both the exporter and the importer.

The advantages of CAD vs. LC are:

- Lower complexity and cost than a letter of credit (easier both for seller and buyer)

- Buyer’s credit lines are not impacted

- Faster process for buyer and seller, as bank intervention is minimal

DOCUMENTARY CREDIT: LETTER OF CREDIT

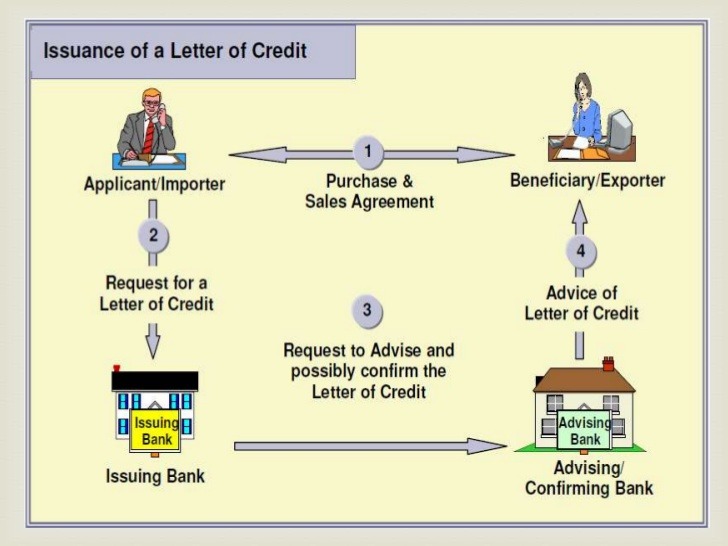

What is a Letter of Credit

A Letter of Credit is a financial instrument issued by a bank, upon the request of a buyer (known as the applicant or importer), to guarantee payment to a seller (known as the beneficiary or exporter) for goods or services provided.

In an LC transaction, the issuing bank commits to pay the beneficiary a specified amount of money, on behalf of the buyer, upon presentation of compliant documents proving that the terms of the sales agreement have been fulfilled. This provides assurance to both the buyer and the seller, as payment is contingent upon the fulfillment of predetermined conditions outlined in the LC.

The terms “Letters of Credit” /or L/C) and “Documentary Credit” (D/C) have the same exact meaning. The first is more common in the USA and Asia, whereas the latter is common terminology in Europe.

Why Does L/C Exist?

Letters of credit are commonly utilized in international trade transactions, particularly when trade partners lack familiarity with each other, operate in distant locations, or are unwilling to assume the payment risks associated with alternative payment terms like open account, bank transfer, or cash against documents.

L/Cs enable trustless transactions between two parties, thanks to the intervention of intermediating banks.

L/C Process Between Buyer/Supplier and Respective Banks

The issuance of a Letter of Credit (L/C) involves several steps:

Agreement: The buyer (applicant) and seller (beneficiary) agree to use an L/C as the method of payment for the transaction.

Application: The buyer submits a request to their bank (issuing bank) to issue an L/C in favor of the seller. The application includes details such as the amount, beneficiary, expiry date, and documents required for payment.

Issuance: Upon receiving the application and any required collateral, the issuing bank issues the L/C. The L/C contains the terms and conditions under which payment will be made.

Notification: The issuing bank sends the L/C to the seller’s bank (advising bank) in the seller’s country or directly to the seller if the L/C is confirmed.

Confirmation (optional): If desired, the seller may request confirmation from their bank or another bank in their country. Confirmation provides additional assurance of payment but usually involves additional fees.

Shipment: The seller prepares and ships the goods according to the terms specified in the L/C, ensuring that all required documents are included.

Presentation: The seller presents the required documents (invoice, bill of lading, packing list, etc.) to the advising bank or confirming bank, demonstrating compliance with the L/C terms.

Examination: The bank examines the documents to ensure they conform to the L/C requirements. If everything is in order, the bank forwards the documents to the issuing bank.

Payment: The issuing bank reviews the documents and, if satisfied, makes payment to the seller or reimburses the advising bank. If discrepancies exist, the issuing bank may seek clarification from the buyer or reject the documents.

Disbursement: Once payment is made, the seller’s bank disburses funds to the seller, completing the transaction.

Throughout this process, the L/C serves as a contractual agreement between the buyer and seller, providing security and assurance of payment.

Before issuing an LC, the buyer/importer shall have approved credit limits with the issuing bank or have cash available in their account.

What is UCP?

UCP stands for “Uniform Customs and Practice for Documentary Credits.” It is a set of guidelines established by the International Chamber of Commerce (ICC) that govern the use of letters of credit (L/C) in international trade. The UCP provides standardized rules and practices to ensure uniformity and clarity in L/C transactions, helping to mitigate risks for both buyers and sellers involved in international trade. The latest version of the UCP is the UCP 600, which was introduced in 2007 and is widely recognized and used in global trade finance.

The Different Types of Letter of Credit

There are a few types of letters of credit, the most common are:

- At Sight LC

- Time/Usance LC

- Differed/Mixed Payment LC

- Revolving LC

- Confirmed LC

- Transferable LC

- Back to Back LC

- Advance Payment LC

- Discounting LC

- Standby LC

In the following chapters, we will review the most common and interesting types, i.e. Standby, Transferable, Back-to-Back.

STANDBY LETTER OF CREDIT (SBLC)

A standby letter of credit (SBLC) is a financial instrument issued by a bank that serves as a guarantee of payment to a beneficiary if the applicant fails to fulfill their obligations under a contract. Unlike traditional letters of credit used in trade transactions, which are triggered by the non-performance of the seller, SBLCs are typically used as a form of financial assurance in various business transactions, such as construction projects, leases, or loan agreements. If the applicant defaults on their obligations, the beneficiary can draw on the SBLC to receive payment from the issuing bank.

Types of Standby Letters of Credit:

Standby letters of credit (SBLCs) can take various forms depending on the specific requirements of the parties involved and the nature of the transaction. Some common types of SBLCs include:

Performance SBLC: This type of SBLC ensures that the applicant performs their contractual obligations, such as completing a project or delivering goods or services, according to the terms of the underlying agreement.

Financial SBLC: Also known as financial standby letters of credit, these instruments serve as a form of payment guarantee for financial transactions, such as loans, leases, or payment obligations. If the applicant fails to make payment as agreed, the beneficiary can draw on the SBLC to receive the funds.

Bid Bond SBLC: Bid bond SBLCs are often used in procurement or bidding processes to guarantee that the bidder will enter into a contract if awarded the bid. If the bidder fails to do so, the beneficiary can draw on the SBLC for compensation.

Advance Payment SBLC: In some cases, a beneficiary may require advance payment before fulfilling their obligations. An advance payment SBLC provides assurance to the beneficiary that they will receive the payment, even if the applicant defaults.

Counter SBLC: A counter standby letter of credit is issued by the beneficiary’s bank in favor of the applicant to provide reciprocal assurance in situations where both parties have payment or performance obligations.

These are just a few examples of the types of SBLCs available, and the specific terms and conditions may vary depending on the agreement between the parties and the requirements of the transaction.

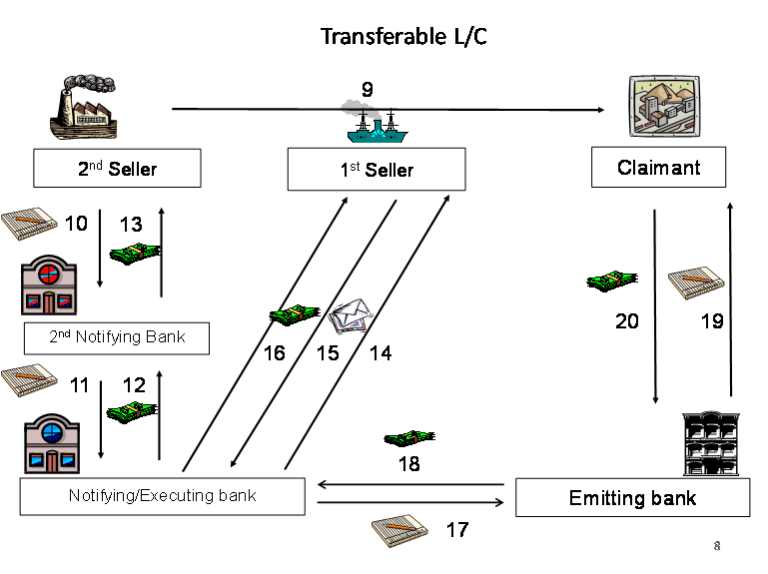

TRANSFERABLE LETTER OF CREDIT

A transferable letter of credit (LC) is a type of LC that allows the original beneficiary (usually an intermediary) to transfer all or part of the credit to one or more secondary beneficiaries. This secondary beneficiary receives payment from the issuing bank based on the original credit terms.

Transferable LCs are commonly used in international trade transactions where the intermediary does not possess the resources or capability to fulfill the entire contract but can subcontract part of the work to other suppliers or manufacturers. This arrangement allows for greater flexibility in sourcing goods or services and can facilitate complex trade transactions involving multiple parties.

Transferable letters of credit (LC) can be classified into two main types based on their structure and purpose:

Partial Transferable LC:

- In a partial transferable LC, only a portion of the credit amount is transferred to the secondary beneficiary.

- The original beneficiary retains control over the remaining balance of the credit.

- This type of LC is commonly used when the original beneficiary intends to subcontract part of the goods or services to multiple suppliers.

Fully Transferable LC:

- In a fully transferable LC, the entire credit amount can be transferred to one or more secondary beneficiaries.

- Once transferred, the original beneficiary relinquishes control over the credit, and the secondary beneficiary becomes the sole beneficiary.

- Fully transferable LCs offer greater flexibility for subcontracting and can accommodate more complex trade arrangements involving multiple suppliers or manufacturers.

These types of transferable LCs provide options for intermediaries to efficiently manage their transactions and facilitate trade relationships with various parties involved in the supply chain.

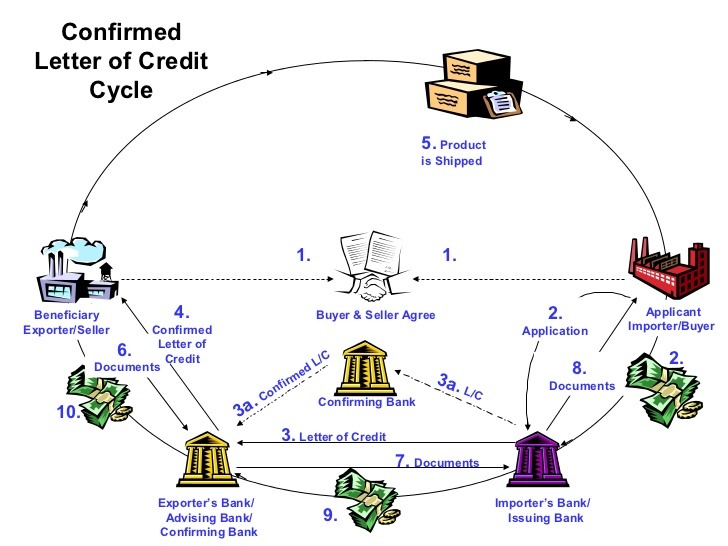

CONFIRMED LETTER OF CREDIT

A confirmed letter of credit (LC) is a type of LC that includes an additional guarantee from a confirming bank, usually located in the beneficiary’s country. In a confirmed LC, the confirming bank adds its commitment to honor the LC’s terms and conditions, providing an extra layer of security for the beneficiary.

This confirmation assures the beneficiary that payment will be made even if the issuing bank or the buyer fails to fulfill their obligations. Confirmed LCs are particularly useful in international trade transactions where there may be concerns about the creditworthiness or reliability of the issuing bank or buyer.

Benefits of Confirmed LC:

Confirmed letters of credit (LCs) offer several benefits to both the beneficiary (seller) and the applicant (buyer) in international trade transactions:

Enhanced security: The confirmation by a second bank adds an additional layer of security for the beneficiary, ensuring payment even if the issuing bank or buyer defaults.

Credibility: Confirmed LCs provide reassurance to the beneficiary that payment will be made, thereby increasing confidence in the transaction and reducing the risk of non-payment.

Mitigation of country risk: In transactions involving parties from different countries, a confirmed LC can help mitigate the risk associated with political or economic instability in the buyer’s country.

Facilitates trade: Confirmed LCs facilitate smoother trade transactions by reducing the risk of disputes and delays related to payment.

Negotiable terms: The terms of a confirmed LC can be negotiated between the beneficiary and the confirming bank, providing flexibility to tailor the LC to specific transaction requirements.

Overall, confirmed LCs offer peace of mind and financial security to both parties involved in international trade, making them a preferred payment mechanism for many exporters and importers.

Back to Back Letter of Credit

A back-to-back letter of credit (LC) is a financial instrument used in international trade transactions where a seller (beneficiary) receives an LC from the buyer’s bank (issuing bank) and then uses that LC to secure a second LC from their own bank (advising bank) in favor of their supplier or manufacturer. The second LC is based on the creditworthiness of the first LC and is used to purchase goods or services required for fulfilling the terms of the original sales contract.

In essence, a back-to-back LC allows the seller to use the value of the original LC as collateral to obtain financing for sourcing goods or services needed to fulfill the buyer’s order. It is commonly used in situations where the seller acts as an intermediary or middleman between the buyer and the supplier, and it provides flexibility in trade finance arrangements.

Back-to-back LCs are interesting instruments used by skilled traders/intermediaries to finance buy-and-sell transactions without using their own capital or collaterals. Under this schema, the trader who is the beneficiary of the letter of credit from an end user may leverage the “main LC” (export LC) and obtain a “secondary” LC (import LC) from his bank in favor of its supplier(s), without using own capital for the transaction.

A back-to-back transaction involves two different (but connected) letters of credit:

- main LC/export LC: the LC issued by the end-user to the trader

- secondary LC/import LC: the LC issued by the trader to its seller (manufacturer, stockholder, or distributor of the goods to be delivered to the end buyer)

The back-to-back LC schema is represented here:

Conditions for a Back-to-Back LC:

Back-to-back LC arrangements are less common, or more difficult to be leveraged, in today’s banking landscape. However, they can still be arranged under certain conditions:

- The trader has a solid track record with the bank.

- The trader is the primary beneficiary of the export LC issued by the end-user.

- The export LC is issued by a reputable bank and can be confirmed by the trader’s advising bank.

- The trader’s suppliers accept payment via LC.

- Both import and export LCs have similar terms and conditions, except for the goods’ price.

While not all banks are open to back-to-back LCs due to inherent risks, they may be considered when banks can ensure a smooth cash flow and understand the transaction’s terms thoroughly.

Comparing Transferable vs. Back-to-Back Letters of Credit

Unlike “transferable” Letters of Credit (LCs), which necessitate the end user’s approval to transfer the credit from the original beneficiary to a new one—a condition often deemed risky and thus seldom accepted—a back-to-back LC operates without requiring such consent. It’s a confidential arrangement between the beneficiary of the “main LC” or “export LC” and their bank.

In this setup, both the end user and the manufacturer of the goods may be completely oblivious to the existence of a back-to-back LC arrangement facilitating the transaction. This method allows the intermediary (the original LC beneficiary) to secure a second LC in favor of their supplier, using the first LC as security. This second LC, issued by the bank, mirrors the first LC’s terms but is independent of it, providing a separate guarantee to the supplier while keeping the overall trade mechanism transparent to both the original buyer and the goods’ manufacturer.

The table shows the balance of risk between buyer and seller under the different payment terms for international sale & purchase contracts mentioned above.

NEED HELP?

We are available to help you with Documentary Collections and Letters of Credit. We offer consulting and access to financing options.

In case of need, contact us.

10 Responses

1. I don’t understand “Telegraph Transfer BZ 180 Days” and “Telegraph Transfer PEKAO SA 180 Days”!

2. What is the full form “BZ” & “PEKAO SA”?

Please advice me & help. Thanks

It is very helpful, I like it but types of LC not discussed all.

I read this post your post is so nice and very informative post thanks for sharing this post.

Hi

I own a trading import export company.

I have now my buyers place some orders to me and they want handle for them these orders.

The orders coming round 3-5 M $USD from CHINESE TURKISH suppliers.

I am looking someone who can offer me the instrument for payment terms open to suppliers L/C.

If someone can do it contact with me immediately !

Thank you in advance !

Yaroslav Varakchuk

E-mail : info@avalone-group.com

Phone : WhatsApp 0042 077 6582241

For which Products sir ?

Cash in advance is one of the most secure payment terms for sellers, and the least secure for buyers. But cash delivery is the best way to achieve trust from the customer and this is the way to develop the brand identity.

Hello,

We can work on the terms of your customer

My customer want to buy mask in L/C at sight and my seller just accept T/T. can you solve this problem?

the deal amount is $2 million.

We can provide masks on sight LC terms

Hello,

We can sell you ffp3 masks lc payment on sight. http://www.mkmedicaltextile.com